Imagine a world where your clients view you not just as a mutual fund distributor, but as a trusted advisor who guides them through every aspect of their financial lives. In today’s ever-changing financial landscape, staying ahead of the curve is essential. The Certified Financial Planner (CFP) certification can make this vision a reality, offering unmatched opportunities to distinguish yourself and advance your career.

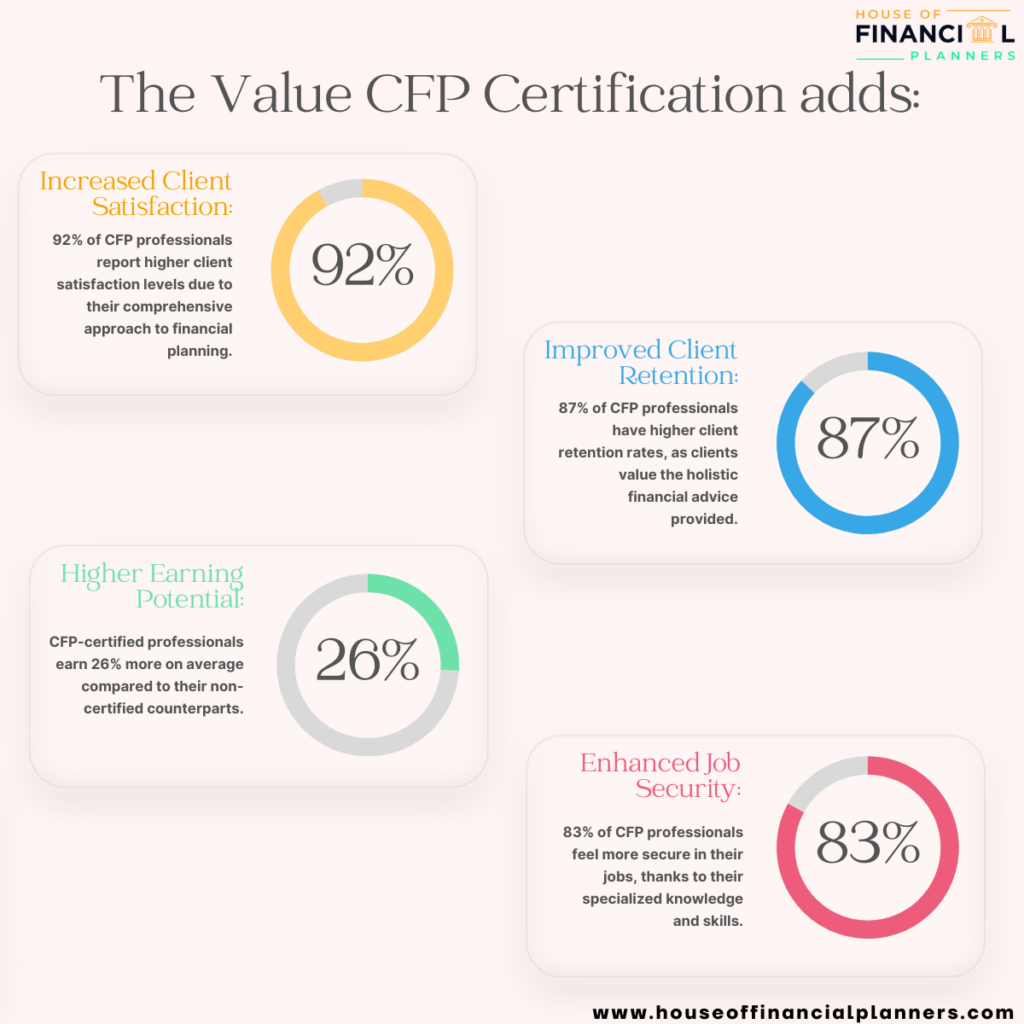

The Value CFP Certificate adds:

- Increased Client Satisfaction: 92% of CFP professionals report higher client satisfaction levels due to their comprehensive approach to financial planning.

- Improved Client Retention: 87% of CFP professionals have higher client retention rates, as clients value the holistic financial advice provided.

- Higher Earning Potential: CFP-certified professionals earn 26% more on average compared to their non-certified counterparts.

- Enhanced Job Security: 83% of CFP professionals feel more secure in their jobs, thanks to their specialised knowledge and skills.

How CFP Certification Can Increase Your Business?

Make Smarter Decisions with Extensive Knowledge

- Knowledge is power, and with a CFP certification, you’ll have a treasure trove of it. Imagine having the ability to make well-informed decisions that not only benefit your clients but also grow your business. With a broad knowledge base, you can tackle estate planning and tax planning with ease, leading to more insightful conversations with your clients. This expertise helps you manage more of their assets and builds a larger, more loyal clientele.

- Why stop at being just a mutual fund distributor? With CFP certification, you can expand your horizons and offer consulting services, including financial planning, estate planning, and tax planning. These additional services are like adding more strings to your bow, attracting new clients and increasing the value you provide to existing ones. As they say, “Variety is the spice of life,” and offering a variety of services spices up your business, making it more attractive and competitive.

How CFP Certification can help you protect your business?

Secure Your Assets Under Management (AUM)

Ring Fencing:- Imagine building a substantial AUM of 100 crores. Now, picture a competitor with advanced knowledge trying to lure your clients away. Scary, right? As a CFP, you can protect your Assets Under Management (AUM) from such potential threats. This certification equips you with the expertise to safeguard your business, ensuring that your clients’ assets remain with you. It’s like building a fortress around your hard-earned assets, creating long-term trust and stability.

The benefits of getting a CFP certification for mutual fund distributors are crystal clear. It boosts your credibility, builds trust with your clients, increases your earning potential, and provides you with extensive financial knowledge. Additionally, it helps you protect your assets under management (AUM) from future threats, ensuring long-term stability for your business. In short, this certification is a smart investment in your career and future success.

Conclusion

As Benjamin Franklin once said, “An investment in knowledge pays the best interest.” If you’re ready to take your career to the next level, consider pursuing CFP certification. Visit the House of Financial Planners for more information on how to get started. Transform your career, enhance your knowledge, and become the financial expert your clients need today!

Don’t just aim for success; strive for significance in your clients’ lives. Get your CFP certification and make a lasting impact.