Are you prepared for a premier learning experience provided by the Financial Planning Standards Board Ltd., the global authority setting standards in the financial planning industry? Whether taken online or through an instructor like House of Financial Planners, FPSB Ltd.’s risk and estate planning course equips you to devise strategies to minimize your clients’ financial risks and effectively manage their accumulated assets.

The course teaches you to evaluate your clients’ legal, tax, financial, and insurance positions, and the impacts of non-financial issues, to guide clients to conserve and transfer wealth consistent with client goals. To be recognized by employers, clients, and the public for your knowledge and competency in retirement and tax planning, complete the roadmap below to obtain FPSB® Risk and Estate Planning Specialist certification in India.

About FPSB Ltd. and FPSB Programs in India

Financial Planning Standards Board Ltd. (FPSB) serves as the global authority for setting standards in financial planning and is the proprietor of the CFPCM, CERTIFIED FINANCIAL PLANNERCMand![]()

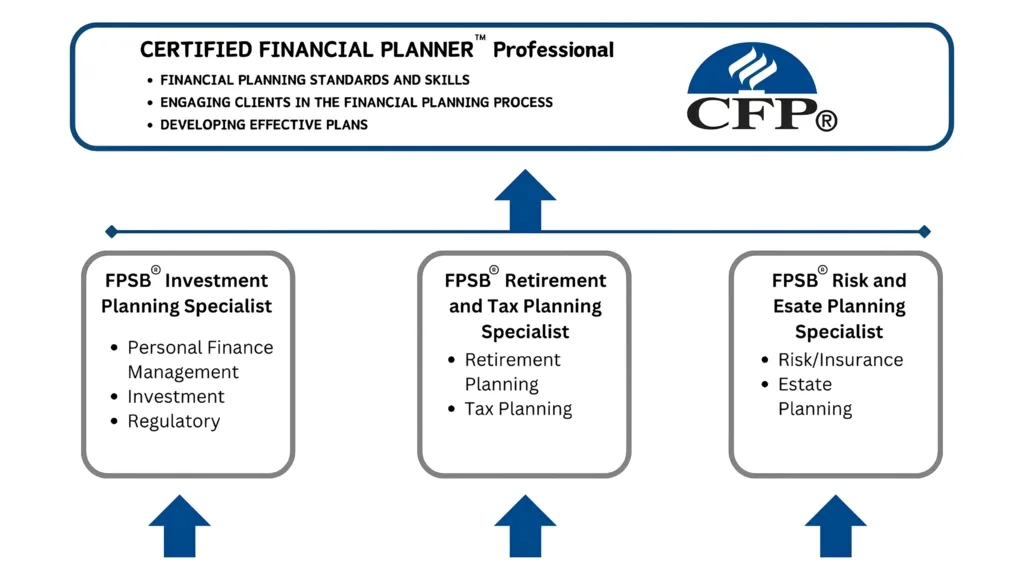

![]() , and marks outside the United States. FPSB proudly offers its Risk and Estate Planning Specialist program, which is one of three pathways to achieving CFP certification in India:

, and marks outside the United States. FPSB proudly offers its Risk and Estate Planning Specialist program, which is one of three pathways to achieving CFP certification in India:

- FPSB® Investment Planning Specialist

- FPSB® Retirement and Tax Planning Specialist

- FPSB® Risk and Estate Planning Specialist

Each certification pathway includes its specific coursework, examination, and credential. Notably, completing these pathway courses also counts towards the educational requirements for CFPCM certification in India. Professionals interested in pursuing CFP certification can start by enrolling with FPSB and choosing any of the three pathway certifications, in any sequence. This document will concentrate on the FPSB Risk and Estate Planning Specialist certification.

FPSB® Risk and Estate Planning Specialist Overview.

Take Your Career to the Next Level

The FPSB® Risk and Estate Planning Specialist course equips you to create strategies that manage clients’ financial exposure arising from personal risks and assists clients in preserving and distributing their accumulated assets.

This course trains you to assess your clients’ legal, tax, financial, and insurance positions, as well as the impacts of non-financial factors, guiding them to protect and transfer wealth in alignment with their objectives. To gain acknowledgment from employers, clients, and the public for your advanced skills and knowledge in risk and estate planning, follow the outlined steps to secure the FPSB® Risk and Estate Planning Specialist certification in India.

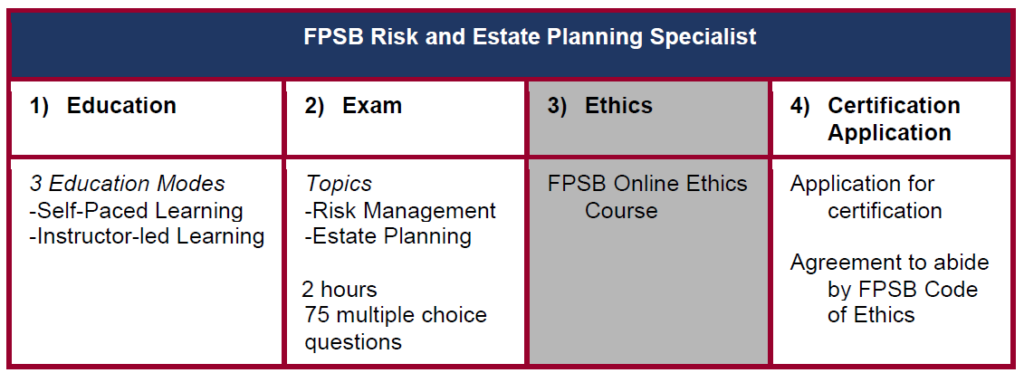

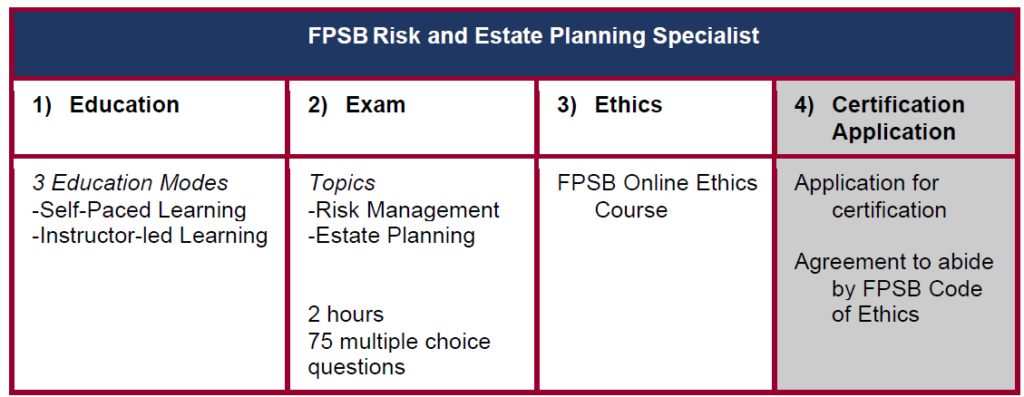

Steps to Initial Certification

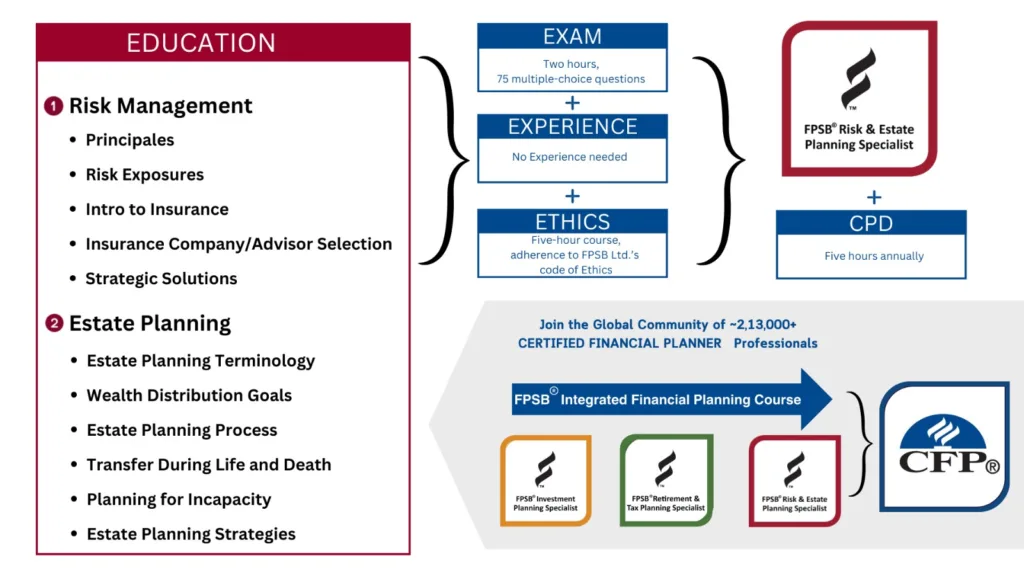

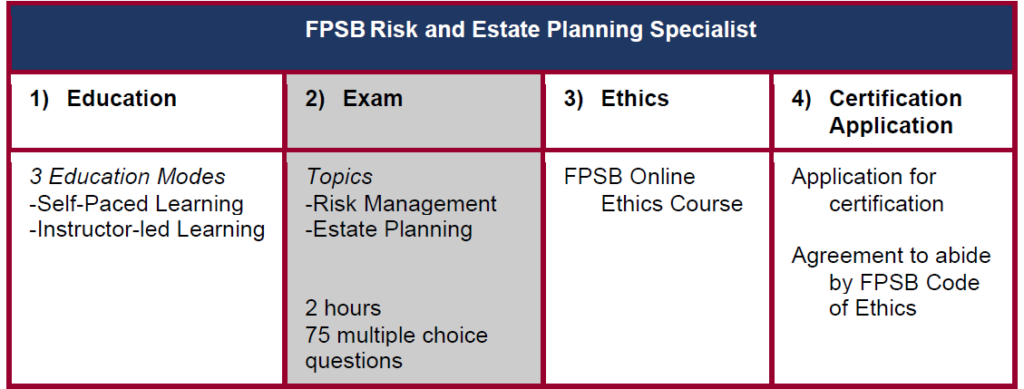

The requirements for FPSB Risk and Estate Planning Specialist certification are as follows:

- Successfully complete the FPSB Ltd. Ethics Course.

- Successfully complete FPSB’s Education modules for:

- Risk Management

- Estate Planning

- Pass the FPSB Risk and Estate Planning Specialist Exam, which aligns with the topics identified in the FPSB Risk and Estate Planning Specialist Competency Profile

- Complete your Certification Application, which includes your agreement to comply with FPSB Ltd.’s Code of Ethics and payment of an annual certification fee.

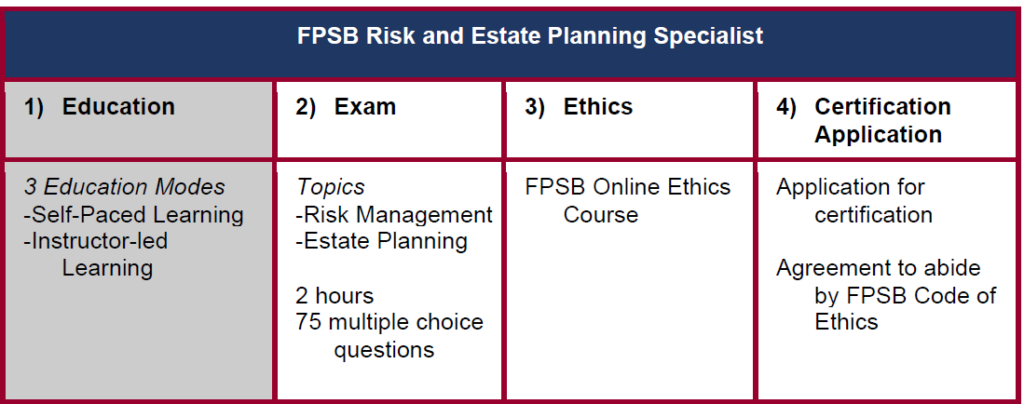

Step 1: Education

Criteria to Register

Candidates must be at least 18 years old and have completed HSC/12th grade (Std XII/HSC) to register with FPSB and start the FPSB Risk and Estate Planning Specialist education course. It is required that candidates register with FPSB at least 30 days before registering for the exam.

Period for Course Completion

Individuals must complete the FPSB Risk and Estate Planning Specialist certification program within three years of their initial registration with FPSB Ltd., and they are required to renew their registration annually. If the program is not completed within three years, FPSB Ltd. will deem the registration invalid. Candidates should evaluate their ability to complete the program within this timeframe before registering.

| Module | Name and Description |

| Risk Management | The material in this course covers risk management and insurance. Upon completion of this course, candidates should have a good understanding of risk management need areas and ways to address them. Candidates should be able to evaluate existing insurance coverage and how it addresses the client’s risk management needs. Finally, candidates should be able to develop various strategies to protect the client’s financial wellbeing through appropriate risk management. |

| Estate Planning | The material in this course covers risk management and insurance. Upon completion of this course, candidates should have a good understanding of risk management need areas and ways to address them. Candidates should be able to evaluate existing insurance coverage and how it addresses the client’s risk management needs. Finally, candidates should be able to develop various strategies to protect the client’s financial well-being through appropriate risk management. |

FPSB Ltd. Educational Resources

FPSB Ltd. It will provide participants of the program with digital textbooks, supplemental practice quizzes after each chapter, post-module exams, and additional course materials via its online learning portal, MyFPSBlearning. All educational resources from FPSB Ltd. are tailored to meet the FPSB Risk and Estate Planning Specialist learning objectives. All candidates, irrespective of their mode of education, are required to purchase these materials.

Education

Candidates may complete the FPSB Risk and Estate Planning Specialist education requirement and become eligible to sit for the certification exam in one of three ways:

- Self-Paced Education

Candidates who enroll with FPSB and choose the “Self-Paced Learning” option will receive a password to access FPSB’s online learning platform, MyFPSBlearning. Here, they can study FPSB’s various educational materials at their own pace and test their understanding through quizzes and module tests to enhance their learning experience. This mode of self-paced education is particularly suitable for seasoned investment professionals or independent learners who prefer to study on their own timetable.

*Self-paced learners who do not pass all FPSB Risk and Estate Planning Specialist module exams after the two attempts will be asked to pursue the instructor-led path by enrolling with an Authorized Education Provider (AEP). The House of Financial Planners is an education provider of FPSB India.

2. Instructor-Led Education

Candidates who want an immersive educational experience with hands-on learning and access to an FPSB Authorized Education Provider should register for “Instructor-Led Learning” when signing up with FPSB. FPSB Authorized Education Providers offer both classroom and online education experiences. When registering with FPSB, individuals who sign up for instructor-led education will be asked to select from amongst FPSB’s authorized providers, which are also listed on the FPSB Ltd. website.

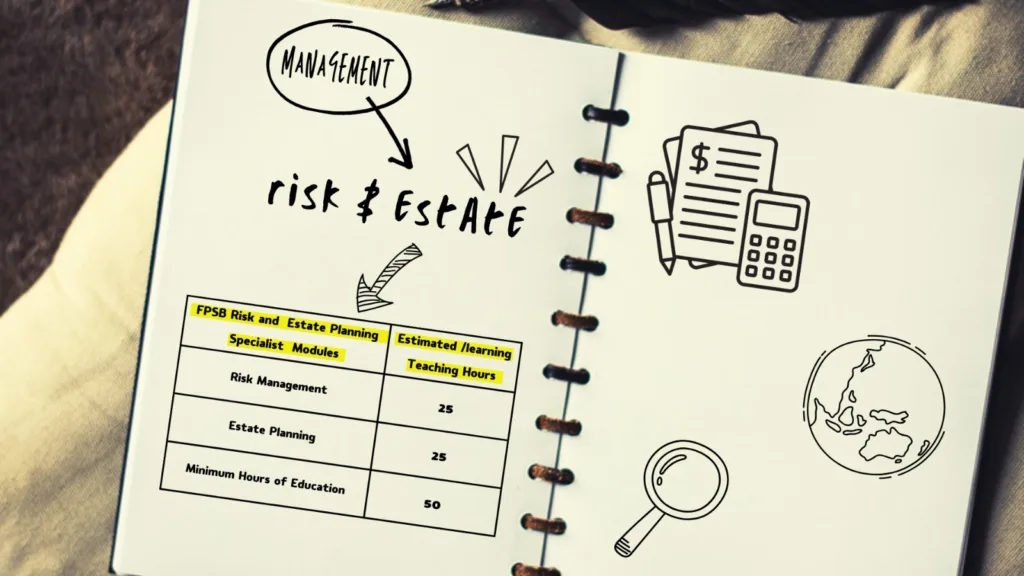

Candidates who opt for FPSB’s instructor-led education can expect to receive the below teaching hours per module.

Step 2. Exam

Upon successful completion of the FPSB® Risk and Estate Planning Specialist education requirement, whether through instructor-led or self-paced education courses, candidates will be able to sit for the FPSB® Risk and Estate Planning Specialist exam.

The exam assesses the level of knowledge, skill, and ability needed to earn the FPSB Risk and Estate Planning Specialist credential, including the functions of collection, analysis, and synthesis (detailed further below). Each question on the exam focuses primarily on a specific element of competency from the FPSB® Risk and Estate Planning Specialist Competency Profile and may require integration across several competencies.

Exam Overview

- 75 multiple-choice questions (4 possible answer choices), of which a minimum of 65 questions are potentially scored and up to 10 questions are used to develop future exams.

- Computer-based testing format

- Duration – two hours

- Financial calculators permitted (data must be erased)

- There will be two possible marks: correct, with points allotted; or incorrect, for zero points. Candidates will not have points deducted (referred to as ‘negative marking’)

Exam Scoring

- The passing point on the FPSB® Risk and Estate Planning Specialist exam is set to a level that is what is required for competent practice. Once set, future exams are equated to this same level so that candidates who take the exam one month have the same opportunity to demonstrate their abilities as candidates who take the exam a different month. The level of ability is what is consistent. This means that even if one exam is harder than another, the equating process gives every candidate the same opportunity to pass.

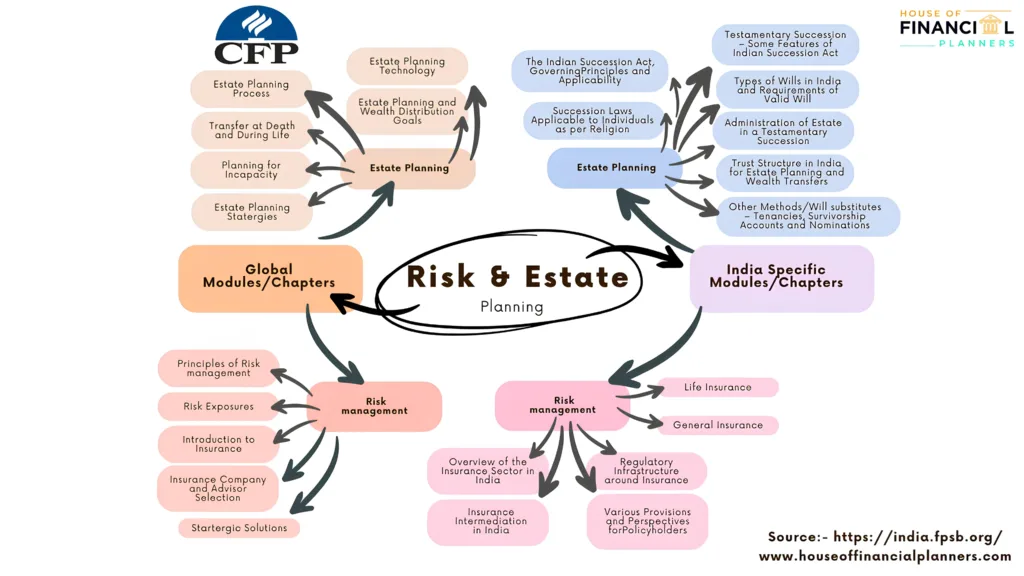

Areas of Practice

The exam will test the following areas of practice, which are also described in more detail in the FPSB Risk and Estate Planning Specialist Competency Profile.

| FPSB Risk and Estate Planning Specialist Areas of Practice | |

| Risk Management – Global 1. Principles of Risk Management 2. Risk Exposures 3. Introduction to Insurance 4. Insurance Company and Advisor Selection 5. Strategic Solutions | Estate Planning – Global 1. Estate Planning Terminology 2. Estate Planning and Wealth 3. Distribution Goals 4. Estate Planning Process 5. Transfer During Life and at Death 6. Planning for Incapacity 7. Estate Planning Strategies |

| Risk Management – India-Specific 1. Overview of the Insurance Sector in India 2. Regulatory Infrastructure around Insurance Insurance 3. Intermediation in India 4. Life Insurance 5. General Insurance 6. Various Provisions and Perspectives for Policyholders | Estate Planning – India-specific 1. The Indian Succession Act, Governing Principles and Applicability 2. Succession Laws Applicable to Individuals as per Religion 3. Testamentary Succession – Some Features of Indian Succession Act 4. Types of Wills in India and Requirements of Valid Will 5. Administration of Estate in a Testamentary Succession 6. Other Methods/Will substitutes – Tenancies, Survivorship 7. Accounts and Nominations 8. Trust Structure in India for Estate Planning and Wealth Transfers |

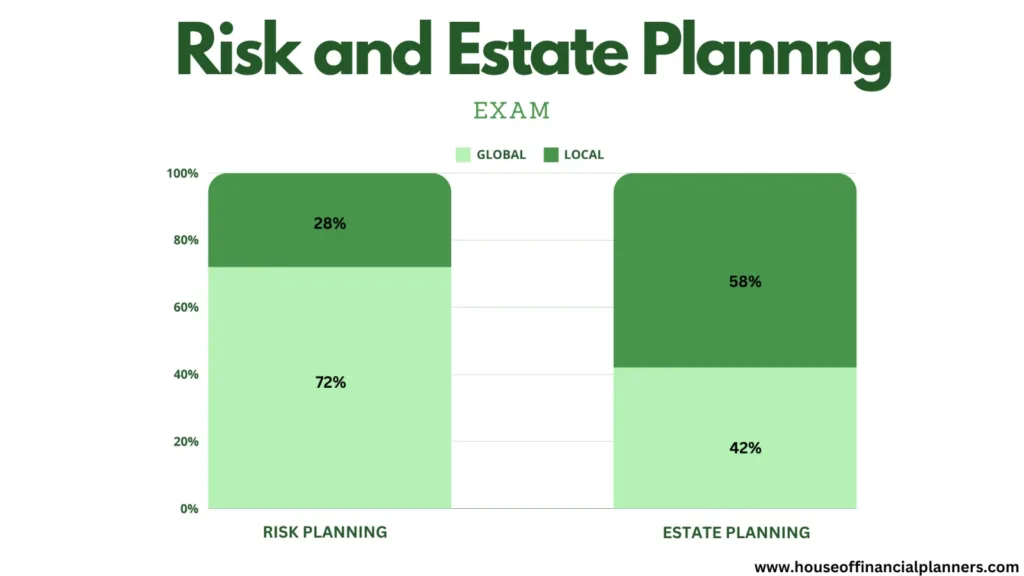

The FPSB® Risk and Estate Planning Specialist exam will test the knowledge, skills and abilities from the FPSB Risk and Estate Planning Specialist education modules in the below proportions. However, there will not be specific sections allocated to the modules. Instead, questions relating to each module will appear in no specific order throughout the exam.

Likewise, although the FPSB® Risk and Estate Planning Specialist textbooks draw a distinction between “global” and “India-specific” education content, exam questions will not be specifically identified as such, and will appear in no specific order throughout the exam.

Difficulty Levels

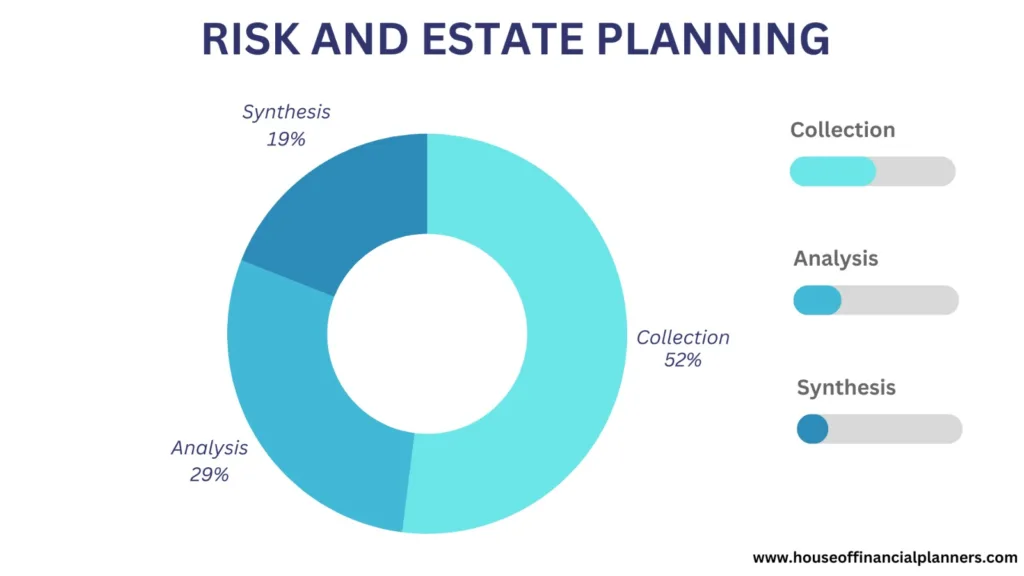

The FPSB Risk and Estate Planning Specialist certification exam is designed to assess knowledge, skills, and abilities in the areas of collection, analysis, and synthesis in approximately the following proportions:

Collection: Gathering information and identifying related facts by making required calculations and arranging client information for analysis. During the collection function, the core competency is to collect both the quantitative and qualitative information required to provide risk management and estate planning advice.

Analysis: Considers issues, performs financial analysis and assesses the resulting information to be able to develop strategies for the client. This includes: (1) considering potential opportunities and constraints in developing strategies, and (2) assessing information to develop strategies.

Synthesis: Integrates the information needed to develop and evaluate strategies to create a risk management and estate planning plan.

Appeal Process

Candidates may choose to appeal the results of an exam by submitting a request at https://india.fpsb.org/product/india-cfp-exam-evaluation/.

Once submitted, exam results will be reviewed in detail and the Candidate will receive additional determination information. Any appeal must be received no later than 30 days from the intimation of the exam result in LMS or through email. The decision after the appeal is completed will be considered final.

Step 3. Ethics

FPSB requires all individuals to successfully complete the FPSB Ethics course soon after they register in the FPSB® Risk and Estate Planning Specialist course. This course is included with the purchase of the course material. Passing the Ethics course and abiding by Code of Ethics is a pre-requisite for holding the FPSB® Risk and Estate Planning Specialist certification. It is required to be passed only once for holding one or more Specialist certifications and CFPCM certification. The FPSB Ethics course is conducted online in MyFPSBlearning. The interactive FPSB Ethics Course consists of recorded instruction that can be taken in one or multiple sittings with knowledge checks throughout. Once completed, the FPSB Ethics Course is valid for all FPSB Ltd. certifications offered in India.

| Introduction | Codes of Ethics |

| Learning Objectives 1. Explain why financial services professionals should study ethics 2. Describe the difference between values and principles 3. Describe the relationship between ethics and the law 4. Describe a financial services professional 5. Identify the characteristics of a professional 6. Evaluate the public perception of the financial services profession Knowledge Items 1. Why financial services professionals should study ethics 2. The difference between values and principles 3. Ethics and the law 4. Characteristics of a financial services professional 5. Public perception of the financial services profession | Learning Objectives 1. Identify the purposes of codes of ethics 2. Distinguish between the reasonable person standard and the professional practice standard 3. Identify the eight principles of FPSB’s Code of Ethics 4. Apply the principles of FPSB’s Code of Ethics to various case studies and examples 5. Construct a personal code of ethics Knowledge Items 1. The purpose of a code of ethics 2. Business conduct standards 3. Reasonable person standard 4. Professional practice standard 5. Eight principles of FPSB’s Code of Ethics 6. Personal code of ethics |

Ethics Attestation

After candidates have passed the FPSB Ethic Course, they must, as part of the FPSB Risk and Estate Planning Specialist certification process, attest and agree to abide by the FPSB Code of Ethics.

Step 4. Initial and Ongoing Certification

Ongoing FPSB Risk and Estate Planning Specialist Certification Requirements

To maintain the right to use the FPSB Risk and Estate Planning Specialist credential, certification holders must maintain their professional skills, knowledge, and abilities through ongoing learning activities.

FPSB Ltd. requires FPSB Risk and Estate Planning Specialists to renew their certification annually. To remain certified as an FPSB Risk and Estate Planning Specialist certification holders must:

✔ Commit to adhere to FPSB Ltd.’s Code of Ethics and any applicable laws and regulations.

✔ Obtain at least five Continuing Professional Development (CPD) hours/points. All points must be completed before applying for renewal of certification. At least two CPD hours/points need to directly relate to FPSB Ltd.’s Code of Ethics.

FPSB Coursework as Continuing Professional Development

FPSB Risk and Estate Planning Specialists who pursue other Specialist courses are considered to have met their annual CPD requirement through the coursework for FPSB’s other financial certifications – as proven by registration in the FPSB Risk and Estate Planning Specialist, FPSB Investment Planning Specialist, or CFPCM certification programs.

Using your Badge and Certification Name Correctly

FPSB will post guidance on how to correctly identify yourself as an FPSB Risk and Estate Planning Specialist. All certification holders will be required to abide by the guidance as part of the FPSB Code of Ethics.

FPSB Risk and Estate Planning Specialist Competency Profile

Global Risk Management and Insurance Planning

Chapter 1: Principles of Risk Management

Learning Objectives

1-1 Identify the types of risk clients potentially face (including pure versus speculative)

1-2 Describe principles of insurance

1-3 Discuss the four techniques used to manage risk.

1-4 Explain the three rules of risk management.

1-5 Compare pure and speculative risk versus perils and hazards.

1-6 Explain the six steps of the risk management process to assess exposure to financial risk.

1-7 Discuss the four factors that insurers consider as requirements for an insurable risk.

1-8 Identify the four insurance concepts that apply to insurance law that affect the operation of the insurance policy.

Knowledge Items

1.1 Fundamentals

1.1.1 Meaning and treatment of risk

1.1.2 Basic risk management assumptions and techniques

1.2 Types of Risk

1.2.1 Pure and speculative risk

1.2.2 Major types of pure risk

1.2.3 Major types of speculative risk

1.2.4 Perils and Hazards

1.3 Personal risk tolerance and management

1.4 Principles of Insurance

1.4.1 Characteristics of Insurance

1.4.1.1 Requirements for an insurable risk

1.4.1.2 The Insurance Contract

Chapter 2: Risk Exposures

Learning Objectives

2-1 Evaluate a client’s personal and general insurance exposures

2-2 Evaluate a client’s risk management needs

Knowledge Items

2.1 Financial obligations: existing and potential

2.2 Analysis and evaluation of risk exposures

Chapter 3: Introduction to Insurance

Learning Objectives

3-1 Explain general insurance.

3-2 Analyze homeowner’s insurance.

3-3 Discuss vehicle insurance.

3-4 Evaluate liabilities and liability insurance.

3-5 Explain traditional and non-traditional life insurance

3-6 Discuss features and provisions of individually-owned life insurance

3-7 Analyze and calculate how much life insurance do people need.

3-8 Compare various types of annuities.

3-9 Discuss health insurance.

3-10 Explain long-term care.

3-11 Evaluate disability insurance.

3-12 Discuss business related insurance.

Knowledge Items

3.1 General Insurance

3.1.1 Homeowners

3.1.2 Personal property

3.1.3 Vehicles

3.2 Liability

3.2.1 Personal liability

3.2.2 Professional liability

3.2.2.1 Malpractice and errors and omissions

3.3 Life insurance

3.3.1 Term life insurance

3.3.2 Traditional – whole life and endowment

3.3.3Non- traditional – universal, adjustable, variable, variable universal

3.3.4 Joint Life Policies

3.3.5 Amount of life insurance needed

3.4.6 Annuities

3.4 Health insurance

3.4.1 Types of Medical Expense Insurance

3.4.2 Managed health care plans

3.4.3 Long-term care (LTC)

3.4.3.1 Common features of LTC insurance policies

3.5 Disability: Personal

3.5.1 Common features of disability insurance

3.5.1.1 Definition of disability

3.5.1.2 Common continuation provisions

3.6 Business-related

3.6.1 Key person

3.6.2 Disability: Business

3.6.3 Business overhead expense

3.6.4 Business liability and board member cover

Chapter 4: Insurance Company and Intermediary Selection

Learning Objectives

4-1 Explain the elements to consider in a company evaluation when selecting an insurance company

4-2 Explain the elements to consider in a due diligence when selecting an insurance advisor (agent).

4-3 Discuss advisor / agent selection and responsibilities.

4-4 Evaluate and choose an insurance policy.

4-5 Discuss legal and financial characteristics of insurance parties.

Knowledge Items

4.1 Company and intermediary selection and due diligence

4.1.1 Company evaluation and selection

4.1.2 Intermediary selection and responsibilities

4.1.3 Choosing an insurance policy

4.2 Legal and financial characteristics of insurance parties involved in an insurance contract

4.2.1 Insurance company

4.2.2 Policy owner

4.2.3 Beneficiary

4.2.4 Insured

4.3 Regulation and Compliance

Chapter 5: Strategic Solutions

Learning Objectives

5-1 Determine potential risk management strategies for a client

5-2 Identify the advantages and disadvantages of risk management strategies

5-3 Optimize risk management strategies to make recommendations

5-4 Prioritize action steps to assist a client in implementing risk management strategies

Knowledge Items

5.1 Risk management priorities

5.1.1 Risk review and evaluation: Property and liability

5.1.2 Risk review and evaluation: Life

5.2 Risk management tools to address risk exposures

5.3 Risk management needs

5.4 Risk management optimization

5.4.1 Risk Management Audit

5.4.2 Implement the chosen approaches

5.4.3 The road map

India-Specific Risk Management and Insurance Planning

Chapter 1: Overview of the Insurance Sector in India

Learning Objectives

- Explain the insurance sector in India

- Describe the laws governing the insurance business in India

Topics

- Economic, Commercial, and Social Aspects of Insurance

- Scope of Insurance Business

- Life Insurance – History and Growth

- General Insurance – Historical Perspective and Potential

- Non-Life Insurance

- Health Insurance

- Re-Insurance

- Laws governing Insurance Business in India

- The Insurance Act, 1938

- The Insurance Laws (Amendment) Act, 2015

- Law relating to Agency under the Indian Contract Act, 1872

- The Consumer Protection Act, 2019

- Doctrines of Waiver and Equitable Estoppel

Chapter 2: Regulatory Infrastructure Around Insurance

Learning Objectives

2-1 Understand the regulatory infrastructure around insurance

2-2 Explain the authorities which control- various insurance functions

Topics

- Insurance Regulatory and Development Authority of India (IRDAI Act, 1999)

- Duties, Powers, and Function

- Licensing and Governance of Insurance Companies and Intermediaries

- Apex Insurance Regulator and Industry Watch-Dog

- Supervision of Tariff Advisory Committee

- Power to Issue Guidelines and Directions

- Insurance Councils and General Insurance Council

- Constitution and Powers

- Self-Regulatory Mechanism

- Insurance Information Bureau of India

- Insurance Ombudsman

- Establishment and Objectives

- Appointment, Tenure and Jurisdiction

- Rights and Powers

- Insurance Institute of India

- Authority and Functions

- Education and Training

Chapter 3: Insurance Intermediation in India

Learning Objectives

3-1 Describe the categories of intermediaries

3-2 Compare other specialists in insurance

Topics

- Categories of Intermediaries, their respective Domains, Functions and Code of Conduct

- Individual Agents

- Corporate Agents, Bancassurance

- Insurance Brokers

- Web Aggregators

- Insurance Marketing Firms

- Point of Sales Persons

- Other Specialists in Insurance (other than procurement)

- Insurance Surveyor or Loss Assessor

- Medical Examiners

- Third party Administrators (TPA)

- Insurance Repositories (electronic issue of insurance policies)

Chapter 4: Life Insurance

Learning Objectives

4-1 Illustrate the structure and organization of life insurance companies in India

4-2 Understand the insurer’s fixing of premium and distribution of benefits

4-3 Illustrate various group insurance schemes

4-4 Understand the features of Insurance Contract and Policy Document

4-5 Distinguish policy revival schemes and claims

Topics

- Structure and Organization of Life Insurance Companies in India

- Mandate and Responsibilities

- Income Sources and Rate-fixing

- Premium and Types

- Factors in Fixation of premium, Rate Making

- Mortality Tables and Actuarial Valuation

- Age, Medical Condition and Sum Assured

- Rates of Guaranteed Benefits

- Right Premium and Adverse Selection

- Distribution of Benefits

- Bonus – With Profit or Participating Plans

- Simple and compound Reversionary Bonus, Guaranteed Addition

- Terminal Bonus, Survival Bonus, Loyalty Addition

- Interim Bonus

- Taxation Aspect of Various Life Insurance Policies for Individuals

- Loans Eligibility against Life Insurance Policies – With Profit, Endowment, and investment Plans

- Group Insurance Schemes

- Group Term Insurance Schemes

- Employees’ Deposit Linked Insurance (EDLI) Scheme

- Group Gratuity Schemes

- Actuarial Valuation; data of retirement, resignation, death, disability

- Methods to Manage – Create internal resources, Set up a Gratuity Fund

- Investment Linked Insurance – Unit Linked Insurance Plan (ULIP)

- Protection, Investment and Income Tax Benefits (subject to Lock-in Period)

- Choice of Plans – Equity, Debt, Hybrid, Money Market Fund and Switch options

- Net Asset Value based redemption, maturity and claim settlement

- Contingency Planning

- Disability insurance with premium waiver option

- Child Plans with premium waiver

- Married Women’s Property Act and Insurance Planning

- Insurance Policy Document and Legal Implications

- Preamble

- Operative Clause

- Proviso

- Schedule

- Attestation

- Conditions and Privileges

- Policy Revival Schemes

- Ordinary and Special Revival

- Installment Revival

- Loan-cum-Revival

- Foreclosure of Policy and Reinstatement provisions

- Surrender of Policy

- Assignment of Policy

- Claims

- Claims by Maturity

- Claims at Periodic Intervals (Money-Back Plans)

- Claims at Maturity (on surviving the Policy term)

- Claims by Death

- Claimant (Nominee/Assignee) or Legal Representative (Proof of Title)

- Documents required – Letter of Intimation, Death Certificate (Proof of Death)

- Non-Early Death Claim (Beyond three years) – Presumed to be Dead for missing persons, applicability of Indian Evidence Act, 1872

- Claims by Maturity

Chapter 5: General Insurance

Learning Objectives

5-1 Explain the Indian general insurance market

5-2 Evaluate the various insurance classifications

5-3 Understand public liability, product liability, professional and employer liabilities

5-4 Distinguish the nuances of Motor Vehicles Act with respect to public liability

5-5 Determine the non-life insurance contract, policy document and legal implications

Topics

- Structure of Indian General Insurance Market

- Government and Private Insurance Companies

- Agents and Brokers

- Loss assessors

- Classification

- Non-Life Insurance

- Health Insurance

- Taxation Aspect of Health Insurance Policies – Individuals, Family and Dependent Senior Citizens

- Taxation Aspect of Group Health Insurance Policies for Corporates

- Agriculture Insurance

- Credit Insurance

- Export Credit Guarantee Corporation of India Limited (ECGC)

- Role of ECGC in Facilitating International Trade

- Reinsurance (General Insurance Corporation of India Limited – GIC Re)

- Mandatory Provisions

- Concept of Ceding

- Liability Insurance – Legal Liability Policies

- Public Liability

- The Public Liability Insurance Act, 1991

- Environmental Impairment Liability (EIL)

- Product Liability

- Professional Indemnities

- Employer’s Liability Insurance

- The Workmen’s Compensation Act, 1923

- The Employees State Insurance Act, 1948 (ESI)

- Role of Powers of Employees State Insurance Corporation (ESIC)

- The Maternity Benefit Act, 1961

- Public Liability

- Motor Insurance

- The Motor Vehicles Act, 1988

- The Motor Vehicles (Amendment) Act, 2019

- Motor Accidents Claim Tribunals

- Types of Losses

- Loss of damage to the Vehicle (Own Damage)

- Third Party Liability (TPL) – Compulsory Insurance

- Policy Document and Legal Implications

- Proposal Form

- Policy Component

- Heading

- Preamble

- Operative Clause

- Policy Schedule

- Signatures

- Exceptions

- Conditions

Chapter 6: Various Provisions and perspectives for Policyholders

Learning Objectives

6-1 Evaluate benefits and limitations of holding multiple policies with different insurers

6-2 Describe group insurance policies by employers and their sufficiency

6-3 Determine merits/demerits of surrendering insurance policy

6-4 Explain benefits and limitations of Keyman insurance from personal and organizational perspectives

6-5 Distinguish between Offline and Online Insurance Policies

6-6 Discuss global coverage of different life and general insurance policies

Topics

- Provisions in insurance when the insurance is taken from multiple companies

- Life insurance policies

- General Insurance policies

- Provisions related to employer provided and group policies – benefits/limitations

- Group life insurance

- Group health insurance

- Provision of life insurance policy surrender – merits/demerits

- Comparative evaluation of various life insurance policies

- Benefits and limitations in different types of non-life insurance policies

- Health insurance and Critical Illness insurance

- Health insurance – basic policy and top-up provisions, floater and super floaters

- Provisions of Keyman insurance – personal and organizational perspectives

- Provisions of Overseas Travel Insurance

- Offline versus Online Insurance Policies

- Global coverage of insurance policies

- Life insurance policies

- General and other non-life insurance policies

Global Estate Planning

Chapter 1: Estate Planning Terminology

Learning Objectives

1-1 Describe estate planning and wealth distribution terms

Knowledge Items

1.0 Estate distribution terminology

1.1 Estate planning and inheritance

1.2 Law: common and civil

1.3 Legal documents and distribution methods

1.4 Property ownership

1.5 Laws of succession and forced heirship

1.6 Incapacity

1.7 Taxable, probate and gross estate

1.8 Gifts

Chapter 2: Estate Planning and Wealth Distribution Goals

Learning Objectives

2-1 Distinguish between estate planning goals

2-2 Determine constraints to meeting estate planning goals

Knowledge Items

2.0 Estate planning and wealth distribution goals

2.1 Discovering client goals

2.2 Common estate planning goals

2.2.1 Providing for loved ones

2.2.2 Children and grandchildren

2.2.3 Providing for organizations and others

2.3 Small business owners

Chapter 3: Estate planning process

Learning Objectives

3-1 Develop steps in the estate planning process

3-2 Determine estate value at death

3-3 Evaluate ways to reduce taxes and expenses at death

Knowledge Items

3.1 Steps in the estate planning process

3.1.1 Creating and reviewing a will

3.1.2 Trusts

3.2 Determine expenses and estate value at death

3.2.1 Estate expenses

3.2.2 Determining estate value

3.3 Ways to reduce taxes and expenses at death

3.3.1 Administration

3.3.2 Debt, tax, and other financial settlement expenses

Chapter 4: Transfer during life and at death

Learning Objectives

4-1 Describe estate distribution/transfer tools

4-2 Distinguish between testamentary and intervivos transfers

4-3 Describe laws of succession and compulsory (forced) heirs

Knowledge Items

4.1 Lifetime transfers

4.1.1 Small business owners

4.2 Transfers at death

4.2.1 Personal representative

4.2.2 Probate process

4.2.3 High net worth individuals

4.3 Forced heirship

Chapter 5: Planning for incapacity

Learning Objectives

5-1 Describe incapacity

5-2 Analyze plans to address incapacity

Knowledge Items

5.1 Degrees of incapacity

5.1.1 Mild cognitive impairment

5.1.2 Severe cognitive impairment

5.2 Forms to file

Chapter 6: Estate planning strategies

Learning Objectives

6-1 Assess specific needs of beneficiaries

6-2 Develop estate planning strategies

6-3 Evaluate advantages and disadvantages of estate planning strategies

Knowledge Items

6.0.1 Common concerns

6.1 Spouse, partner, ex-spouse

6.1.1 Spouse

6.1.2 Unmarried partner

6.1.3 Ex-spouse

6.2 Lifetime (inter vivos) gifts

6.3 Children and grandchildren

6.4 Intrafamily transfers

6.5 Disclaiming an inheritance

India-Specific Estate Planning

Chapter 1: The Indian Succession Act, Governing Principles and Applicability

Learning Objectives

1-1 Understand the legal structure of estate and succession in India

1-2 Understand the key principles under the Indian Succession Act, 1925.

1-3 Understand the law governing succession of individuals based on religion.

Topics

1.1 The Indian Succession Act, 1925

1.1.1 Law of situs of land – Immovable property

1.1.2 Law of domicile of testator – Movable property

1.1.2.1 Domicile of Origin

1.1.2.2 Acquisition of new domicile (taking up fixed habitation)

1.1.3 Kindred or Consanguinity

1.1.3.1 Lineal Consanguinity

1.1.3.2 Collateral Consanguinity

1.1.3.3 Mode of computing of degree of kindred

1.1.4 Intestate Succession

1.1.4.1 Deceased has not made testamentary disposition (Will)

1.1.4.2 The testamentary disposition is untenable or invalid

1.1.4.3 Distribution based on laws of inheritance based on religion of the deceased

1.1.4.4 Hindu Succession Act, 1956

1.1.4.5 Mohammedan Law (Muslim Personal Law)

1.1.4.6 Provision of Indian Succession Act applies to Parsis and Indian Christians

1.1.4.7 Succession certificate and/or Letter of Administration

1.1.4.8 Mutation and process of distribution of Estate

Chapter 2: Succession Laws Applicable to Individuals as per Religion

Learning Objectives

2-1 Understand the applicability of succession laws based on religion of a person

2-2 Understand basic principles of the Hindu Succession Act, 1956 and Mohammedan Law.

Topics

2.1 The Hindu Succession Act, 1956 (applies to Hindus, Buddhists, Sikhs, Jains)

2.1.1 Principle of Propinquity (proximity of relationship)

2.1.2 General rules of succession (on priority)

2.1.2.1 Distribution of property among Class I heirs

2.1.2.2 Distribution of property among Class II heirs

2.1.2.3 Order of succession among ‘agnates’ and ‘cognates’

2.1.2.4 Blood relationships (Full Blood, Half Blood, Uterine Blood)

2.1.3 Hindu Succession (Amendment) Act, 2005

2.1.4 Daughter is allotted the same share as son

2.1.5 Share of pre-deceased son/pre-deceased daughter would devolve to their respective children

2.2 The Muslim Personal Law (Shariat) Application Act, 1937 (deals with marriage, succession, inheritance and charities among Muslims)

2.2.1 Primary Sources of Muslim law in India (The Quran, Sunna of Hadis, Ijma, Qiya)

2.2.2 A bequest of entire property to one heir to the exclusion of all others is void

2.2.3 Only one third of total property through a will (Wasiyatnama)

2.2.4 If bequest (of one-third) to one heir, the consent of other heirs is required in Sunni law

2.2.5 If bequest (of one-third) to a non-heir (stranger), the consent of heirs is not required

2.2.6 The bequeathable one-third will not apply to a case where the testator has no heir

2.2.7 A bequest to a child in womb is valid if born within 6 months (Sunni law)

2.2.8 A bequest to a child in womb is valid if born up to 10 months, i.e. longest gestation period (Shia law)

2.2.9 Rateable abatement of legacy applies (Sunni), Rule of chronological priority applies (Shia)

2.2.10 Heir’s consent should be given after the death of testator (Sunni)

Chapter 3: Testamentary Succession – Some Features of Indian Succession Act

Learning Objectives

3-1 Understand common definitions.

3-2 Identify the applicability and salient features of the ISA.

Topics

3.1 Person capable of making wills (Section 59)

3.1.1 animus testandi (intention to make a testament)

3.1.2 Of sound mind, capable of making judgment

3.1.3 Intention to have a testamentary operation

3.1.4 No collateral objects (inducing other person/s to comply with testator’s wishes)

3.2 Lapse of Legacy (Section 105 and 106)

3.3 Bequest made to a class of persons (Section 111)

3.4 Rule against perpetuity (Section 114)

3.5 Onerous, Independent and Contingent Bequests (Section 122-124)

3.6 Specific and Demonstrative Legacy (Section 150)

Chapter 4: Types of Wills in India and Requirements of Valid Will

Learning Objectives

4-1 Distinguish between the different types of Wills.

4-2 Understand the basic requirements of a valid Will.

Topics

4.1 Privileged Will (Oral Will in the presence of two witnesses)

4.2 Contingent Will

4.3 Concurrent Will (cross border bequests)

4.4 Mutual Will

4.5 Joint Will

4.6 Holograph (handwritten) Will

4.7 Duplicate Will (Revocation of testator destroys copy in his/her custody)

4.8 Requirements of a valid Will

4.8.1 Duly and validly executed Will (registration not mandatory)

4.8.2 Mandatory attestation by at least two witnesses

4.8.3 Appointment of executor of the Will

4.8.4 Will needs to be revisited periodically for material change in circumstances

Chapter 5: Administration of Estate in a Testamentary Succession

Learning Objectives

5-1 Understand the role and powers vested in an executor.

5-2 Understand the importance and general procedure of obtaining a probate.

Topics

5.1 The Executor – Legal Representative in fiduciary capacity

5.2 Power, Role and Responsibility as conferred by Indian Succession Act

5.3 Procedure for Probate

5.3.1 The death certificate of the testator (State Authority)

5.3.2 Verify and declare that the Will attached is final testament and duly executed

5.3.3 The value of assets likely to be inherited

5.3.4 The executor is so authorized in the Will

5.4 Get the Will verified by a competent court (Grant of Probate)

5.5 Aggregate inventory of estate and assess value

5.6 Establish solvency of the estate; pay expenses, pay off debt on priority

5.7 Honor specific legacies and proportionate general legacies

Chapter 6: Other Tools and Methods, Will substitutes – Tenancies, Survivorship Accounts and Nominations

Learning Objectives

6-1 Understand joint tenancy and tenancy-in-common in relation to holding of, and succession to, immovable property.

6-2 Understand the effect of joint holding, and nomination, in relation to the management and transmission of securities and investments.

6-3 Understand the effect of nominations made in relation to holdings in a co-operative society ownership structure.

Topics

6.1 Tenant-in-Common and Joint Tenant

6.2 Contracts – Holdings on Any/Either or Survivor basis in bank accounts, Mutual Funds and Securities Accounts

6.3 Nomination in Life insurance Policies

6.4 Nomination in Housing Society documents

6.5 Married Women’s Property Act and Estate Planning

6.6 Other Tools for Estate Planning – Power of Attorney

6.6.1 Powers of Attorney, its use and purpose

6.6.2 Types of Power of Attorney – general and special

6.6.3 Revocation of PoA

6.6.4 Limitations of PoA holder

6.6.5 PoA executed abroad

Chapter 7: Gifts, Trusts & Family Arrangements in Estate Planning

Learning Objectives

7-1 Understand basic law relating to gifts of movable and immovable property.

7.2 Distinguish between different types of trusts.

7-3 Understand the advantages of adopting a trust vehicle of estate planning.

7-4 Understand the value of trust structures in small/family businesses.

7-5 Understanding family arrangements and settlements and their role in estate planning

Topics

7.1 Gifts

7.1.1 Inheritance Tax

7.1.2 Tax on Gifts

7.1.2.1 Moveable Property – Fair Market Value

7.1.2.2 Immovable Property – Stamp Duty

7.1.3 Other Tools for Estate Planning – Power of Attorney

7.1.3.1 Powers of Attorney, its use and purpose

7.3.1.2 Types of Power of Attorney – general and special

7.1.3.3 Revocation of PoA

7.1.3.4 Limitations of PoA holder

7.2 The Indian Trusts Act,1882

7.2.1 Definitions

7.2.2 Types of Trusts

7.2.2.1 Testamentary & Non-Testamentary Trusts

7.2.2.2 Public, Charitable or Religious Trusts & Private Trusts

7.2.2.3 Revocable & Irrevocable Trusts

7.2.2.4 Non-Discretionary & Discretionary Trusts

7.3 Advantages of Private Trusts

7.3.1 Planning succession

7.3.2 Ring fencing of assets

7.3.3Tax planning

7.3.4 Protecting persons with special needs

7.3.5 Flexibility

7.3.6 Transparency in management

7.3.7 Strategic objectives

7.3.8 Trust as a Pass-through entity

7.4 Exception – HUF Property

7.5Succession planning for small businesses

7.6 Business succession

7.7 Offshore Trusts

7.8 Family Arrangements

FPSB Certification Code of Ethics (for all FPSB certifications)

FPSB LTD. CODE OF ETHICS

Observing the highest ethical and professional standards allows professionals to serve the interests of clients and promote the profession for the benefit of society. As part of their commitment, professionals should provide appropriate disclosures and comply with ethical standards when delivering advice to clients. FPSB has incorporated ethical behavior and judgment, and compliance with ethical standards, into its global standards for professionals. To ensure these obligations are understood, FPSB incorporates ethical standards into its certification requirements.

FPSB’s Code of Ethics Principles are statements expressing in general terms the ethical standards that professionals should adhere to in their professional activities. The comments following each Principle further explain the intent of the Principle. The Principles are aspirational and are intended to provide guidance for professionals on appropriate and acceptable professional behavior.

FPSB’s Code of Ethics Principles reflect professionals’ recognition of their responsibilities to clients, colleagues and employers. The Principles guide the performance and activities of anyone involved in the practice of advice; the concept and intent of these Principles are adapted and enforced on professionals by FPSB through rules of professional conduct.

Principle 1 – Client First

Place the client’s interests first.

Placing the client’s interests first is a hallmark of professionalism, requiring the specialist to act honestly and not place personal gain or advantage before the client’s interests.

Principle 2 – Integrity

Provide professional services with integrity.

Integrity requires honesty and candor in all professional matters. Professionals are placed in positions of trust by clients, and the ultimate source of that trust is the specialist’s personal integrity. Allowance can be made for legitimate differences of opinion, but integrity cannot co-exist with deceit or subordination of one’s principles. Integrity requires the specialist to observe both the letter and the spirit of the Code of Ethics.

Principle 3 – Objectivity

Provide professional services objectively.

Objectivity requires intellectual honesty and impartiality. Regardless of the services delivered or the capacity in which a specialist functions, objectivity requires that professionals ensure the integrity of their work, manage conflicts of interest and exercise sound professional judgment.

Principle 4 – Fairness

Be fair and reasonable in all professional relationships. Disclose and manage conflicts of interest.

Fairness requires providing clients what they are due, owed or should expect from a professional relationship, and includes honesty and disclosure of material conflicts of interest. Fairness involves managing one’s own feelings, prejudices and desires to achieve a proper balance of interests. Fairness is treating others in the same manner that you would want to be treated.

Principle 5 – Professionalism

Act in a manner that demonstrates exemplary professional conduct.

Professionalism requires behaving with dignity and showing respect and courtesy to clients, fellow professionals, and others in business-related activities, and complying with appropriate rules, regulations and professional requirements. Professionalism requires the specialist, individually and in cooperation with peers, to enhance and maintain the profession’s public image and its ability to serve the public interest.

Principle 6 – Competence

Maintain the abilities, skills and knowledge necessary to provide professional services competently.

Competence requires obtaining and maintaining an adequate level of abilities, skills and knowledge in the provision of professional services. Competence also includes the wisdom to recognize one’s own limitations and when consultation with other professionals is appropriate or referral to other professionals necessary. Competence requires the specialist to make a continuing commitment to learning and professional improvement.

Principle 7 – Confidentiality

Protect the confidentiality of all client information.

Confidentiality requires that client information be protected and maintained in such a manner that allows access only to those who are authorized. A relationship of trust and confidence with the client can only be built on the understanding that the client’s information will not be disclosed inappropriately.

Principle 8 – Diligence

Provide professional services diligently

Diligence requires fulfilling professional commitments in a timely and thorough manner and taking due care in delivering professional services.