Are you prepared for an excellent educational opportunity provided by Financial Planning Standards Board Ltd.(FPSB), the organization that sets standards for the worldwide financial planning industry? The retirement and tax planning course from FPSB Ltd. can be taken online or with an instructor like House of Financial Planners FPSB Ltd.’s retirement and tax planning course helps you create strategies to increase your clients’ wealth and manage their money better as they approach and go through retirement. It also guides you how to use tax planning to help achieve their goals.

The course teaches you to take into account your client’s individual financial objectives, risk capacity and tolerance, asset locations, the composition and effects of public and private retirement plans, and the effects of taxes on your clients’ financial status and objectives. To gain recognition from employers, clients, and the public for your expertise in retirement and tax planning, follow the steps outlined below to achieve the FPSB Retirement and Tax Planning Specialist certification in India.

About FPSB Ltd. and FPSB Programs in India

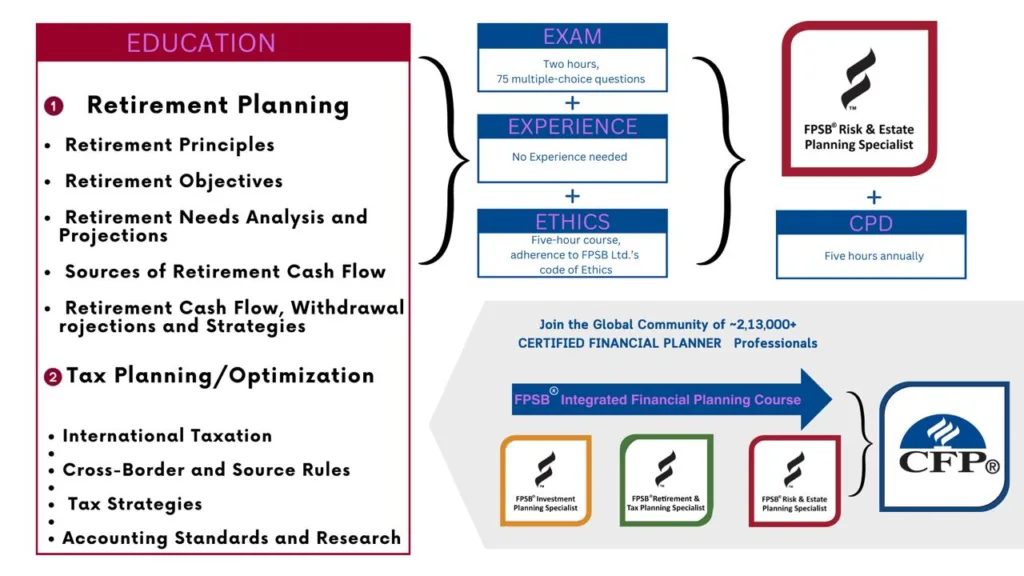

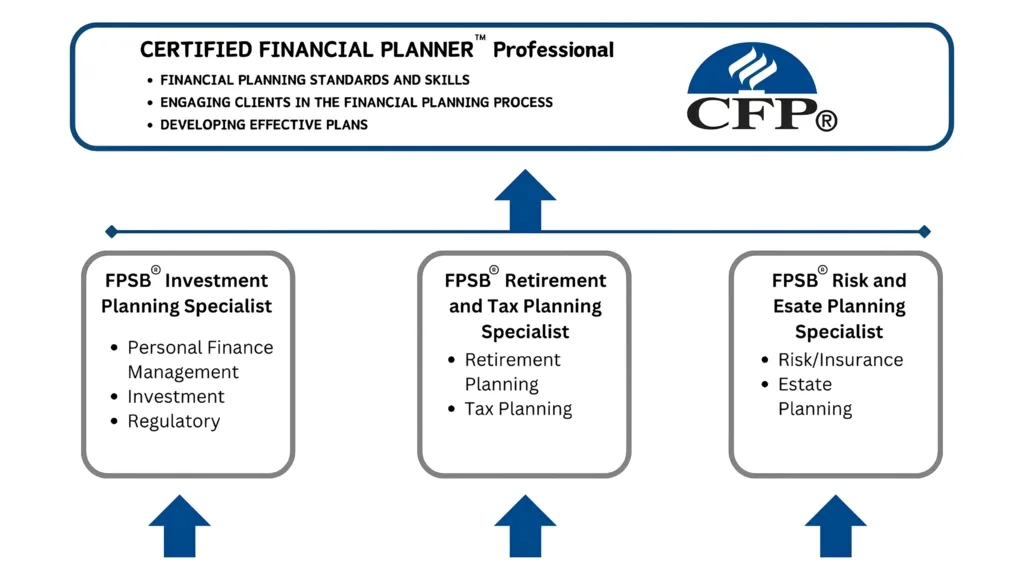

The Financial Planning Standards Board Ltd. (FPSB) sets global standards for financial planning and owns the CFPCM, CERTIFIED FINANCIAL PLANNERCM and marks outside the United States. FPSB proudly offers FPSB’s Retirement and Tax Planning Specialist program, which is one of three pathways to achieving CFP certification in India:

- FPSB® Investment Planning Specialist

- FPSB® Risk and Estate Planning Specialist

- FPSB® Retirement and Tax Planning Specialist

Each certification pathway has specific requirements, including coursework, exams, and credentials. Notably, completing FPSB’s pathways also counts towards the educational requirements needed for CFPCM certification in India. Professionals interested in pursuing CFP certification can start by enrolling with FPSB for any of these three pathway certifications in any sequence. This blog will specifically address the FPSB Retirement and Tax Planning Specialist certification.

FPSB® Retirement and Tax Planning Specialist Overview

Take Your Career to the Next Level

Available online or through an instructor like House of Financial Planners, the FPSB® Retirement and Tax Planning Specialist course equips you to create strategies that enhance your clients’ wealth and cash flow as they approach and enter retirement, and it provides guidance on incorporating tax planning to support their objectives.

This course instructs you to analyze your clients’ personal financial goals, their risk tolerance and risk capacity, asset allocation, the structure and impact of public and private retirement plan, and how taxation will affect your clients’ financial situation and goals. To gain recognition from employers, clients, and the public for your advanced expertise in retirement and tax planning, follow the steps provided below to earn your FPSB® Retirement and Tax Planning Specialist certification in India.

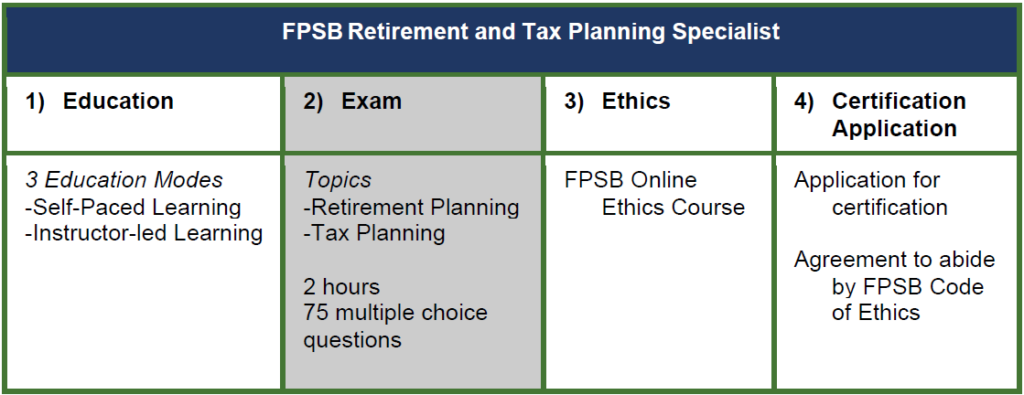

Steps to Initial Certification

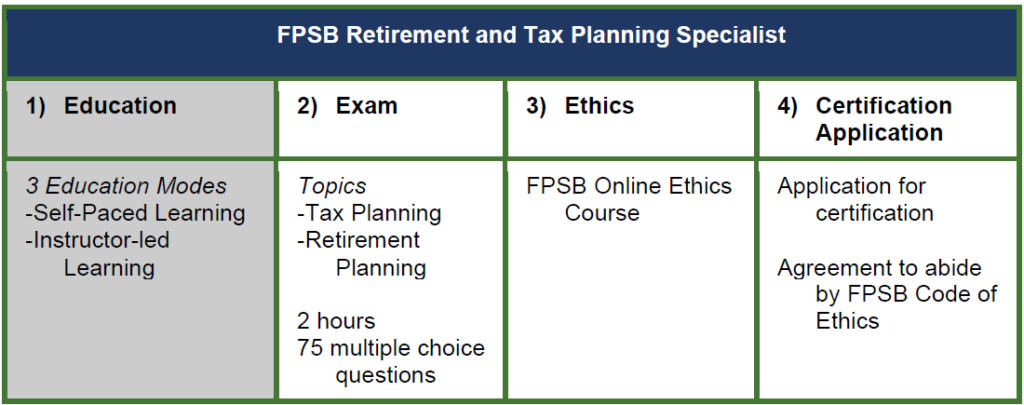

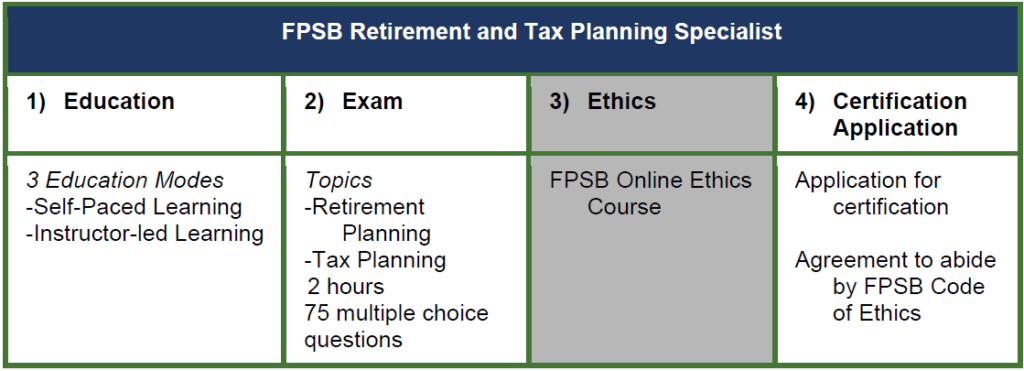

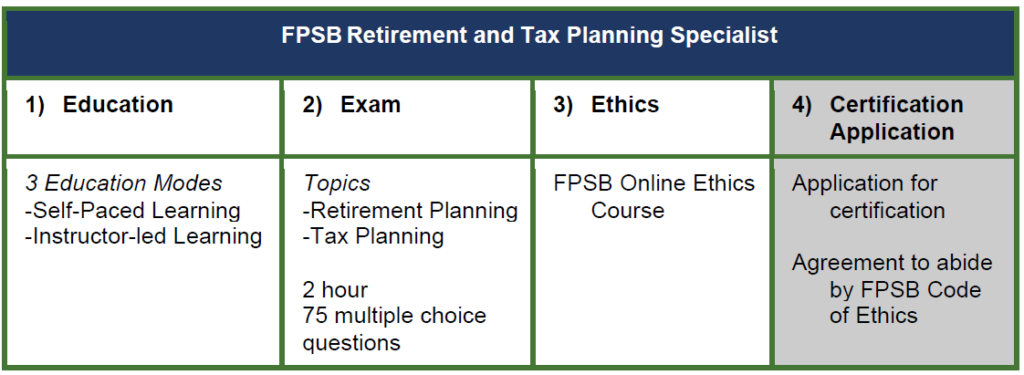

The requirements for FPSB® Retirement and Tax Planning Specialist certification are as follows:

- Successfully complete the FPSB Ltd. Ethics Course.

- Successfully complete FPSB’s education modules for:

- Tax Planning

- Retirement Planning

- Pass the FPSB® Retirement and Tax Planning Specialist exam, which aligns to the topics identified in the FPSB Retirement and Tax Planning Specialist Competency Profile

- Complete your certification application, which includes your agreement to comply with FPSB Ltd.’s Code of Ethics and payment of an annual certification fee.

Step 1: Education

Criteria to Register

Candidates must be at least 18 years old and have completed HSC/12th grade (Std XII/HSC) to enroll with FPSB and start the FPSB Retirement and Tax Planning Specialist education course. It is required that candidates register with FPSB at least 30 days before registering for the exam.

Period for Course Completion

Individuals are required to finish the FPSB® Retirement and Tax Planning Specialist certification program within three years from their initial registration with FPSB Ltd. and must renew their registration every year. If the program is not completed within three years, FPSB Ltd. will deem the registration invalid. Candidates should evaluate their ability to meet this timeline before registering.

FPSB Ltd. Educational Resources

FPSB Ltd. will provide program participants with digital textbooks, supplementary post-chapter quizzes, post-module exams, and additional course materials via its online learning platform, MyFPSBlearning. All educational resources provided by FPSB Ltd. are tailored to the FPSB Retirement and Tax Planning Specialist learning. Every candidate, irrespective of their chosen method of study, must acquire these materials.

Education

Candidates may complete the FPSB® Retirement and Tax Planning Specialist education requirement and become eligible to sit for the certification exam in one of three ways:

1. Self-Paced Education

Candidates who sign up with FPSB and choose the “Self-Paced Learning” option will be given a password to access FPSB’s online learning portal, MyFPSBlearning. There, they can study and interact with various FPSB learning materials at their own pace, and evaluate their understanding through quizzes and module tests, enhancing their learning experience. This self-directed educational path may be especially suitable for appealing to experienced investment professionals or self-starters who enjoy studying on their schedule.

*Self-paced learners who do not pass all FPSB Retirement and Tax Planning Specialist module exams within two attempts, they will be required to switch to the instructor-led method by registering with an Authorized Education Provider (AEP). The House of Financial Planners is one of the AEP’s of FPSB

2. Instructor-Led Education

Candidates seeking a comprehensive educational experience with interactive learning and access to an FPSB Authorized Education Provider should choose the “Instructor-Led Learning” option when registering with FPSB. FPSB Authorized Education Providers deliver both classroom and online learning experiences. Upon registering for instructor-led education with FPSB, individuals will be prompted to choose from among FPSB’s authorized providers, all of which are detailed on the FPSB Ltd. website.

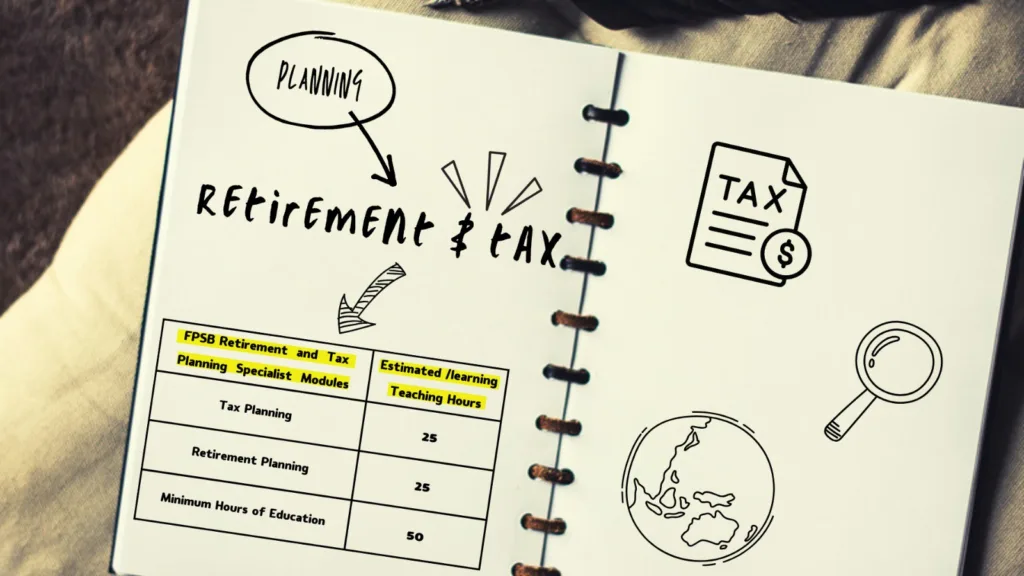

Candidates who opt for FPSB’s instructor-led education can expect to receive the below teaching hours per module.

Step 2. Exam

After successfully finishing the FPSB Retirement and Tax Planning Specialist education requirement, either through instructor-led options like House of Financial Planners or via a self-paced education course, candidates will be eligible to take the FPSB® Retirement and Tax Planning Specialist exam.

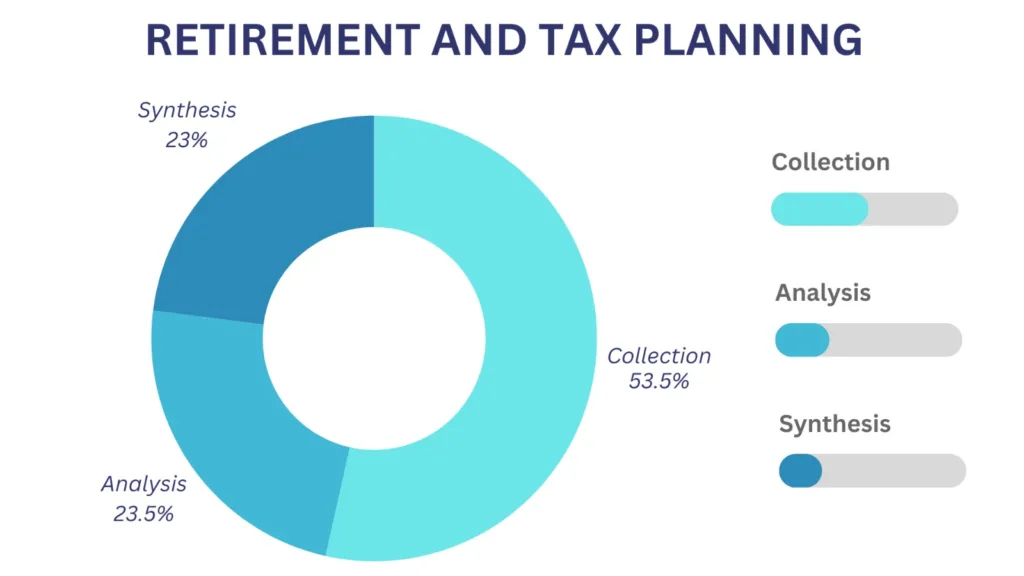

This exam evaluates the knowledge, skills, and abilities required to obtain the FPSB® Retirement and Tax Planning Specialist credential. It focuses on the essential functions of collection, analysis, and synthesis, which are further elaborated below. Each exam question primarily targets a specific competency element outlined in the FPSB Retirement and Tax Planning Specialist Competency Profile and might involve integrating multiple competencies.

Exam Overview

- 75 multiple-choice questions (4 possible answer choices), of which a minimum of 65 questions are potentially scored and up to 10 questions are used to develop future exams.

- Computer-based testing format

- Duration – two hours

- Financial calculators permitted (data must be erased)

- There will be two possible marks: correct, with points allotted; or incorrect, for zero points. Candidates will not have points deducted (referred to as ‘negative marking’)

Exam Scoring

- The passing point on the FPSB® Retirement and Tax Planning Specialist exam is set to a level that is what is required for competent practice. Once set, future exams are equated to this same level so that candidates who take the exam one month have the same opportunity to demonstrate their abilities as candidates who take the exam a different month. The level of ability is what is consistent. This means that even if one exam is harder than another, the equating process gives every candidate the same opportunity to pass.

Areas of Practice

The exam will test the following areas of practice, which are also described to in more detail in the FPSB Retirement and Tax Planning Specialist Competency Profile.

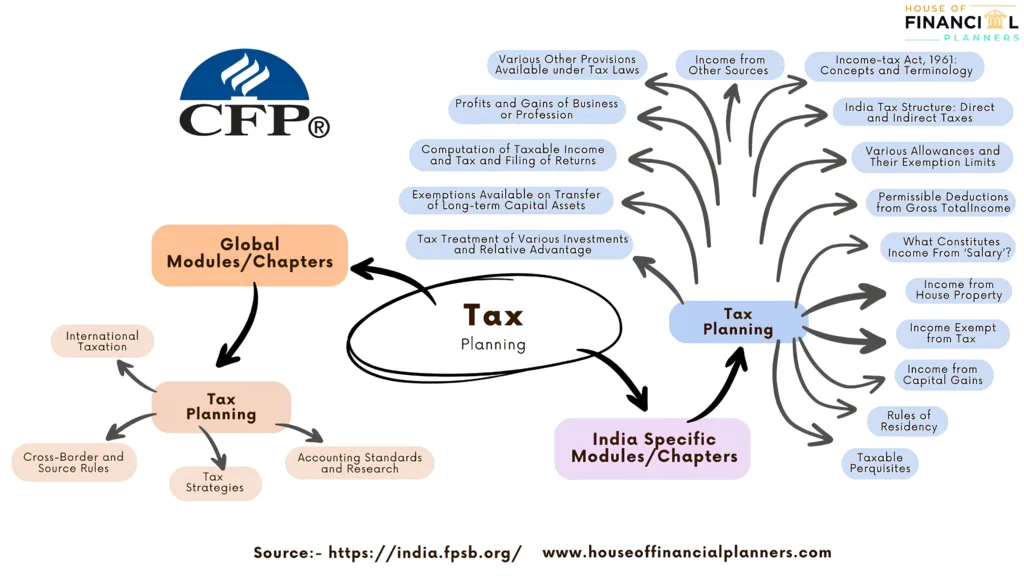

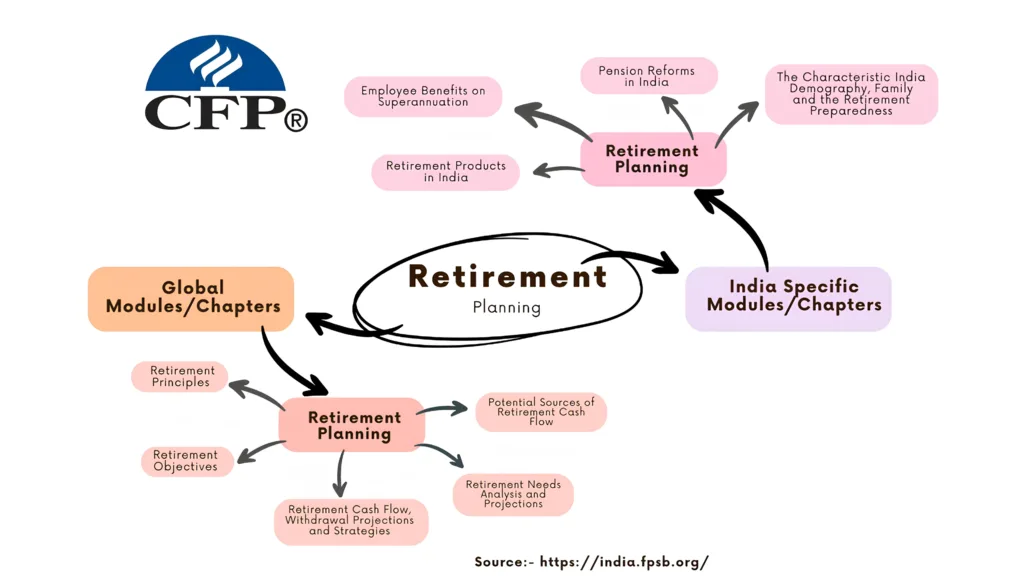

| FPSB Retirement and Tax Planning Specialist Areas of Practice | |

| Retirement Planning 1. Retirement Principles 2. Retirement Objectives 3. Retirement Needs Analysis and Projections 4. Potential Sources of Retirement Cash Flow 5.Retirement Cash Flow, Withdrawal Projections and Strategies | Tax Planning 1. International Taxation 2. Cross-Border and Source Rules 3. Tax Strategies 4. Accounting Standards and Research |

| India Specific Modules/Chapters | |

| Retirement Planning | Tax Planning |

| 1. The Characteristic India Demography, Family, and the Retirement Preparedness 2. Pension Reforms in India 3. Retirement Products in India 4. Employee Benefits on Superannuation | 1. India Tax Structure: Direct and Indirect 2. TaxesIncome-tax Act, 1961: Concepts and Terminology 3. Rules of Residency 4. What Constitutes Income From ‘Salary’? 5.Various Allowances and Their Exemption Limits 6. Taxable Perquisites 7. Income from House Property 8. Income from Capital Gains 9. Income from Other Sources 10. Income Exempt from Tax 11. Exemptions Available on Transfer of Long-term Capital Assets 12. Permissible Deductions from Gross Total Income 13. Profits and Gains of Business or Profession 14. Tax Treatment of Various Investments and Relative Advantage 15. Various Other Provisions Available under Tax Laws 16. Computation of Taxable Income and Tax and Filing of Returns |

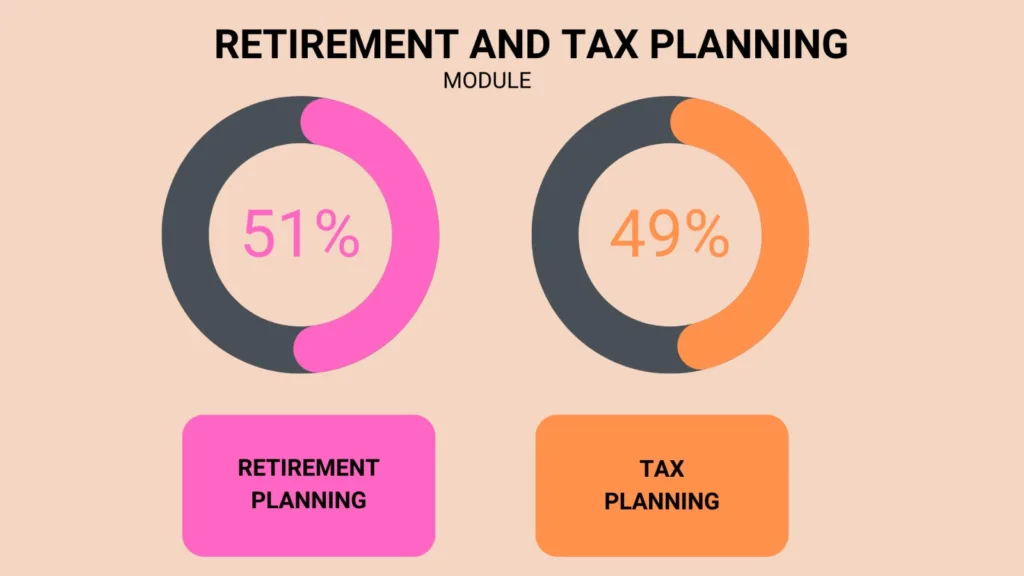

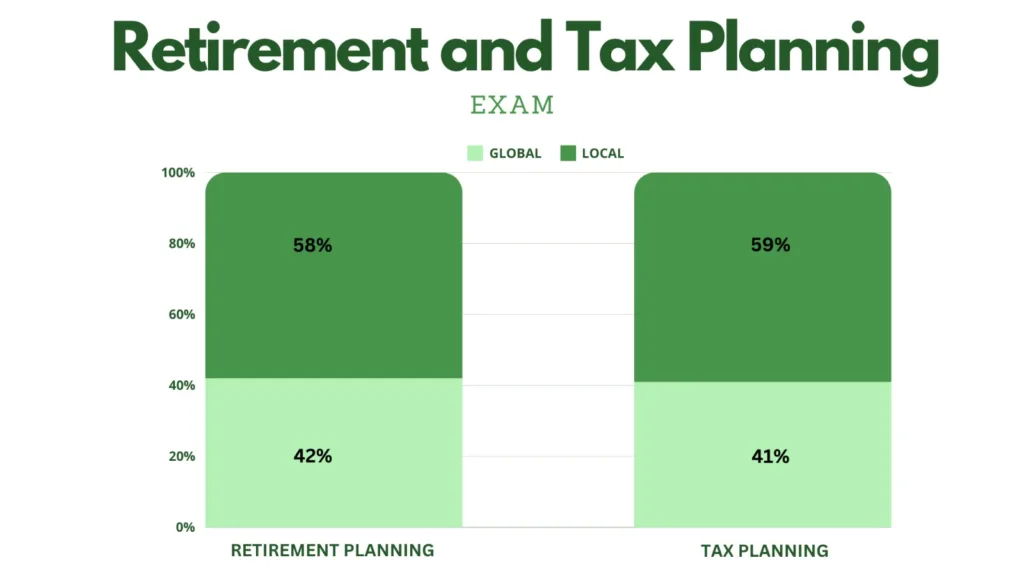

The FPSB Retirement and Tax Planning Specialist exam will test the knowledge, skills and abilities from the FPSB Retirement and Tax Planning Specialist education modules in the below proportions. However, there will not be specific sections allocated to the modules. Instead, questions relating to each module will appear in no specific order throughout the exam.

Likewise, although the FPSB Retirement and Tax Planning Specialist textbooks draw a distinction between “global” and “India-specific” education content, exam questions will not be specifically identified as such, and will appear in no specific order throughout the exam.

Difficulty Levels

The FPSB Retirement and Tax Planning Specialist certification exam is designed to assess knowledge, skills and abilities in the areas of collection, analysis and synthesis in approximately the following proportions:

- Collection: Gathering information and identifying related facts by making required calculations and arranging client information for analysis. During the collection function, the core competency is to collect both the quantitative and qualitative information required to provide retirement advice.

- Analysis: Considers issues, performs financial analysis and assesses the resulting information to be able to develop strategies for the client. This includes: (1) considering potential opportunities and constraints in developing strategies, and (2) assessing information to develop strategies.

- Synthesis: Integrates the information needed to develop and evaluate strategies to create a retirement plan.

Appeal Process

Candidates may choose to appeal the results of an exam by submitting a request at https://india.fpsb.org/product/india-cfp-exam-evaluation/.

Once submitted, exam results will be reviewed in detail and the Candidate will receive additional determination information. Any appeal must be received no later than 30 days from the intimation of the exam result in LMS or through email. The decision after the appeal is completed will be considered final.

Step 3. Ethics

FPSB mandates that all individuals complete the FPSB Ethics course shortly after registering for the FPSB® Retirement and Tax Planning Specialist course. This course, included with the course materials purchase, is crucial as passing it and adhering to the Code of Ethics are prerequisites for obtaining the FPSB® Retirement and Tax Planning Specialist certification. The requirement to pass the Ethics course applies only once, even if pursuing multiple Specialist certifications and the CFPCM certification. Conducted online via MyFPSBlearning, the FPSB Ethics Course features interactive, recorded lessons that can be completed in one or several sessions, with periodic knowledge assessments. Once finished, this course fulfills the ethics training requirement for all FPSB Ltd. certifications available in India.

Ethics Attestation

After candidates have passed the FPSB Ethic Course, they must, as part of the FPSB Retirement and Tax Planning Specialist certification process, attest and agree to abide by the FPSB Code of Ethics.

| 1. Evaluate the public perception of the financial services profession Knowledge Items 1. Why financial services professionals should study ethics 2. The difference between values and principles 3. Ethics and the law 4. Characteristics of a financial services professional 5. Public perception of the financial services profession | 1. Construct a personal code of ethics Knowledge Items 1. The purpose of a code of ethics 2. Business conduct standards 3. Reasonable person standard 4. Professional practice standard 5. Eight principles of FPSB’s Code of Ethics 6. Personal code of ethics |

Step 4. Initial and Ongoing Certification

Ongoing Certification Requirements

To retain the FPSB Retirement and Tax Planning Specialist credential, certification holders are required to continually update their professional skills, knowledge, and competencies through ongoing educational activities.

FPSB Ltd. mandates that FPSB Retirement and Tax Planning Specialists renew their certification every year. To remain certified, you must:

✔ Commit to adhere to FPSB Ltd.’s Code of Ethics and any applicable laws and regulations.

✔ Obtain at least five Continuing Professional Development (CPD) hours/points. All points must be completed before applying for renewal of certification. At least two CPD hours/points need to directly relate to FPSB Ltd.’s Code of Ethics.

FPSB Coursework as Continuing Professional Development

FPSB Retirement and Tax Planning Specialists who pursue other Specialist courses are considered to have met their annual CPD requirement through the coursework for FPSB’s other financial certifications – as proven by registration in the FPSB Risk and Estate Planning Specialist, FPSB Investment Planning Specialist, or CFPCM certification programs.

Using your Badge and Certification Name Correctly

FPSB will post guidance on how to correctly identify yourself as an FPSB Retirement and Tax Planning Specialist. All certification holders will be required to abide by the guidance as part of the FPSB Code of Ethics.

FPSB Retirement and Tax Planning Specialist Competency Profile Module:

Retirement Planning

Global Retirement Planning

Chapter 1: Retirement Principles

Learning Objectives

1-1 Explain the value of planning for retirement

1-2 Analyze strategies for funding retirement

Knowledge Items

1.1 Value of early and consistent planning for retirement

1.2 Investing for retirement

1.2.1 Accumulation strategies

Chapter 2: Retirement Objectives

Learning Objectives

2-1 Identify a client’s retirement objectives

2-2 Evaluate the implications of a client’s attitudes toward retirement

2-3 Evaluate trade-offs needed to meet a client’s retirement objectives

2-4 Calculate capital required to fund a client’s retirement

Knowledge Items

2.1 Retirement goals and objectives

2.1.1 Goals and needs

2.1.2 Capital required for retirement

2.1.3 High net worth clients

2.2 Establishing retirement cash flow targets

2.2.1Conflicting goals and trade-offs

2.3 Objectives in retirement

2.4 Wealth transfer

Chapter 3: Retirement Needs Analysis and Projections

Learning Objectives

3-1 Identify the types of information to collect regarding a client’s estimated retirement expenses 3-2 Analyze financial goals and obligations

3-3 Calculate financial projections in retirement based on a client’s current financial position 3-4 Calculate amounts required to fund retirement cash flow needs

3-5 Analyze the impact of changes in assumptions on financial projections

Knowledge Items

3.1Longevity risk, inflation and the impact on retirement cash flow needs

3.2 Goal classification and funding

3.2.1 Fixed and terminable

3.2.2 Fixed and permanent

3.2.3 Variable and terminable

3.2.4 Variable and permanent

3.3 Goal development

3.3.1 Establishing goals and timelines

3.3.2 Determining goal priorities

3.4 Selecting and administering long-term investment portfolios

3.4.1 Risk, return and implications for retirement planning

Chapter 4: Potential Sources of Retirement Cash Flow

Learning Objectives

4-1 Identify details to collect of a client’s potential retirement cash flow sources

4-2 Analyze retirement benefits provided by the government

4-3 Analyze retirement benefits provided by employers

4-4 Explain how annuities are used to provide retirement cash flow

Knowledge Items

4.1 Pension funds

4.1.1 Government-sponsored

4.1.1.1 Defined benefit plans

4.1.2 Employer-sponsored

4.1.2.1 Defined contribution plans

4.2 Types of non-pension employee retirement benefits

4.3 Individual retirement plans

4.4 Annuities

4.4.1 Types of annuities

4.4.2 Settlement and payout options

Chapter 5: Retirement Cash Flow, Withdrawal Projections and Strategies

Learning Objectives

5-1 Calculate and analyze financial projections for a client’s retirement plan.

5-2 Describe whether a client’s retirement objectives are realistic

5-3 Describe the impact of changes in assumptions on financial projections

5-4 Calculate, analyze, and explain factors impacting retirement account distributions.

5-5 Apply retirement distribution strategies

Knowledge Items

5.1 Sources of cash flow in retirement

5.2 Portfolio distribution strategies

5.3 Retirement distribution rates

5.4 Sequence risk

5.4.1 Portfolio distribution options

5.5 Impact of taxes on retirement cash flow

India-Specific Retirement Planning

Chapter 1: The Characteristic India Demography, Family and the Retirement Preparedness

Learning Objectives

1-1 Understand India demography and potential disruptions in the future

1-2 Compare fiscal constraints with social security programs

1-3 Explain characteristics of the Indian family unit

Topics

1.1. A young India with low old age dependency ratio

1.2 Improving Life Expectancies, other Potential Disruptions to India Demography

1.3 Fiscal Constraints to deal with Large-scale Social Security Programs

1.4 A typical Indian Family – Three generations living together is still more common

1.5 Other Priority Goals and Obligations delay or disrupt retirement savings

1.6 Late Marriages and subsequent goals blur usual Life Stages

Chapter 2: Pension Reforms in India

Learning Objectives

2-1 Explain Old Age Social and Income Security (OASIS) Project

2-2 Distinguish pension scenario and defined benefit schemes

Topics

2.1 Old Age Social and Income Security (OASIS) Project

2.2 Pension Scenario – State Governments, Autonomous Bodies and Un-organized Sector

2.3 Government – Decisive shifting away from Defined Benefit Schemes

2.4 Mandatory contributory system

Chapter 3: Retirement Products in India

Learning Objectives

3-1 Understand employee provident funds and their digital transition

3-2 Illustrate National Pension System’s (NPS) infrastructure, functioning and advantages

3-3 Explain Public Provident Fund (PPF) and other voluntary institutional retirement products

3-4 Evaluate annuities and reverse mortgage schemes

Topics

3.1 Provident Funds

3.1.1 Employees’ Provident Fund and Employees’ Pension Scheme

3.1.2 Other recognized Provident Fund Types

3.1.3 Defined Contribution Plans – Institutional Framework and Investment Architecture

3.1.4 Tax Benefits on Subscriptions and Withdrawals

3.1.5 Universal Account Number (UAN) and Employer Portability

3.2 National Pension Systems (NPS) – PFRDA (Pension Fund) Regulations, 2015

3.2.1 Signature Scheme of Pension Fund Regulatory and Development Authority (PFRDA)

3.2.2 Unique Permanent Retirement Account Number (PRAN) and Portability Features

3.2.3 Types of Accounts – Tier-I and Tier-II

3.2.4 Tier-I Account (Meant for retirement savings)

3.2.4.1 Tax Treatment – Exempt-Exempt-Taxed (EET)

3.2.4.2 Withdrawal Limits on Retirement, Taxability and other Rules

3.2.4.3 An Exclusive Additional Tax Deduction under Section 80CCD(1B)

3.2.4.4. Other Features – Very Low Cost, Regulated and Funds based (Accumulated Units)

3.2.4.5 Annuity Provisions and Annuity Service Providers (PFRDA empaneled)

3.2.4.6 Partial withdrawal, Premature withdrawal, continuation and deferment

3.2.5 Tier-II Account (Voluntary savings facility)

3.2.6 Investment or Portfolio options in NPS – Active and Auto choices

3.2.7 Point of Presence (POP) Service Providers

3.2.8 Central Recordkeeping Agency (CRA)

3.2.9 Pension (NPS) Fund Managers – Roles and Responsibilities

3.2.10 NPS Trust

3.2.11 Trustee Bank

3.2.12 Retirement Advisers and Aggregators

3.2.12 NPS Models

3.2.12.1 All Citizen Model

3.2.12.2 Government Sector and Corporate Model

3.2.12.3 Atal Pension Yojana (APY)

3.3 Public Provident Fund (PPF) under the Public Provident Fund Act, 1968

3.3.1 Structure and Administration

3.3.2 Subscription – Minimum/Maximum and Frequency

3.3.3 Tenure, Rules of Partial Withdrawal and Loan Facility

3.3.4 Taxability – Exempt- Exempt- Exempt (EEE)

3.3.5 Maturity Profile of PPF and Roll-over Facility – With or Without Subscription

3.3.6 Viability of PPF Scheme – A Credible Aggregator of Retirement Corpus

3.4 Pension Plans from Mutual Funds and Insurance Companies

3.4.1 Pension plans from Mutual Funds

3.4.1.1 Tax Benefit and Lock-in Period, Systematic Monthly/Annual Investments in Units

3.4.1.2 Lock-in Period and Withdrawal prior to Retirement

3.4.1.3 Systematic Withdrawal on Retirement akin to Annuity with Benign Taxation

3.4.2 Pension plans from insurance companies

3.4.2.1 Unit-Linked Pension Plans

3.4.2.2 Mortality and Tax Benefits

3.4.2.3 Lock-in Period and Flexible Plan Tenure

3.5 Annuities

3.5.1 Provided by Life Insurers (Regulated by Insurance Regulatory and Development Authority of India – IRDAI)

3.5.2 Minimum Limits for Annuities

3.5.3 Immediate and Deferred Annuities

3.5.4 Types – Period Certain, Life Certain and Life with Period Certain, With or Without Return of Purchase price

3.6 Government sponsored regular income schemes

3.6.1 Senior Citizens Savings Scheme (SCSS)

3.6.2 Post Office Monthly Income Scheme (POMIS)

3.7 Reverse Mortgage

3.7.1 Rules of Reverse Mortgage in India and Regulator National Housing Bank (NHB)

3.7.2 Lump sum payment, Credit Line and Fixed Annuity

3.7.3 Reverse Mortgage Loan Enabled Annuity (RMLeA)

Chapter 4: Employee Benefits on Superannuation

Learning Objectives

4-1 Understand Payment of Gratuity Act, 1972

4-2 Discuss other superannuation benefits and some government schemes

Topics

4.1 Payment of Gratuity Act, 1972

4.1.1 Applicability of the Act

4.1.2 Payment on Superannuation, Disability and Resignation from Employment

4.1.3 Special Provisions and Calculation of Gratuity payable on Death

4.1.4 Determination of the Amount of Gratuity – Formula and Other Rules

4.1.5 Notice for Payment, Period mandated, Recovery and Penalties

4.1.6 Tax-exempt Amount of Gratuity for Employees covered under the Act, and otherwise

4.2 Leave Encashment – Tax-exempt amounts

4.3 Ex-Gratia Lump-sum Compensation

4.4 Pension Scheme for Government Employees – Rules for Commuting pension

4.5 Family Pension

4.6 Employees’ Deposit Linked Insurance Scheme (EDLIS)

4.7 Pensions in Public Sector Bank and other Public Sector Enterprises

Module: Tax Planning and Optimization

Global Principles of Taxation

Chapter 1: Taxes payable by an individual

Learning Objectives

1−1 Identify tax-related terms

1-2 Describe types of taxes payable by an individual

1-3 Illustrate taxation of capital asset

1-4 Describe the difference between tax avoidance and tax evasion

Knowledge Items

1.1 Taxes payable by an individual

1.2 Effect of selling property

1.3 reduction/management techniques

1.4 Tax avoidance/evasion

1.5 Income shifting techniques (transfer and timing)

1.6Tax-exempt income

1.7 Tax-sheltered income

1.8 Tax-preferred retirement, education and spending plans

1.9 Investment strategies to manage tax liability

Chapter 2: Cross-border and Source

Learning Objectives

2-1 Describe cross-border taxation

2-2 Identify income source rules

2-3 Explain tax treaties and their implications

2-4 Describe tax arbitrage

2-5 Explain cross-border treatment of retirement plan distributions

Knowledge Items

2.1 Cross-border taxation

2.2 Tax treaties

2.3 Tax arbitrage

Chapter 3: Tax Planning Strategies

Learning Objectives

3-1 Describe international accounting principles

3-2 Explain organizational ownership structures and tax implications

3-3 Construct tax forms appropriate for filing

Knowledge Items

3.1 Eliminating or reducing tax

3.1.1 Shifting tax to others

3.1.2 Deferring income taxes

3.2 International tax systems overview

3.2.1 Tax arbitrage

3.2.2Tax strategies

3.2.3 Income tax

3.2.4 Tax terms

3.2.5 Property-related taxes

3.2.5.1 Personal property

3.2.5.2 Investment property

2.3.6 Capital assets: Gains and losses

3.3 Suitability

3.4 Strategic coordination

3.5 Tax-free versus taxable yields

3.6 Tax planning action steps

Chapter 4: Accounting Standards and Research

Learning Objectives

4-1 Describe international accounting principles

4-2 Explain organizational ownership structures and tax implications

India-Specific Principles of Taxation

Chapter 1: India Tax Structure: Direct and Indirect Taxes

Learning Objectives

1-1 Understand the tax structure in India

1-2 Describe direct taxes as they apply to individuals and other entities

Topics

- Central Board of Direct Taxes (CBDT), Income-tax Act, 1961, Income-tax Rules, 1962

- Central Board of Indirect Taxes and Customs (CBIC), Central Goods and Services Tax (GST) Act, 2017

Chapter 2: Income-tax Act, 1961: Concepts and Terminology

Learning Objectives

2-1 Identify various terms as contained in the Income-tax Act

2-2 Explain broad principles that define ‘Income’ and other receipts

Topics

- Assessment Year’ (AY), ‘Previous Year’, ‘Assessee’, ‘Person’

- Broad Principles that categorize ‘Income’, Extended meaning of income

- Capital and Revenue Receipts, and their Taxability

Chapter 3: Rules of Residency

Learning Objectives

3-1 Illustrate norms that establish the tax status of residents

3-2 Determine factors which differentiate Indian income from foreign income

Topics

- Residential status of an individual and other taxable entities

- Taxability based on Residential status

- Individuals – Resident in India, Ordinarily Resident and Not-ordinarily resident

- Individuals – Not-resident in India (NRI)

- Residential Status of a Foreign Company

- Residential Status of Hindu Undivided Family (HUF)

- Residential Status of ‘any other person’

- Incidence of Tax or Tax Liability

- Indian Income and Foreign Income

- Income ‘received’ vs. ‘accrue’ or ‘arise’ in India

- Income deemed to accrue or arise in India

Chapter 4: What Constitutes Income From ‘Salary’?

Learning Objectives

4-1 Describe salary received in various forms and under various heads

4-2 Distinguish all receipts which are recognized and taxed within the meaning salaries

Topics

- Salary received, salary due, arrears of salary, advance salary

- Various heads of salary and their taxability

- Various allowances including Dearness Allowance

- Various perquisites

- Profits in lieu of salary

- Wages

- Fees and Commission

- Gratuity, Exemption limits – Government and other employees – on retirement or resignation

- Annuity and Pension – Taxability of commuted pension amount – received with or without Gratuity payment

- Leave encashment on retirement or resignation

- Balance in recognized Provident Fund

- Employer contribution under notified pension scheme, National Pension System (NPS) and recognized Provident Funds

- Compensation received on Voluntary Retirement/Separation Schemes – Exemption limits for IT commissioner approved VRS/VSS schemes

Chapter 5: Various Allowances and Their Exemption Limits

Learning Objectives

5-1 Distinguish allowances which are exempt subject to rules and limits based on actual expenditure

5-2 Identify the rules and limits for various other specific allowances

Topics

- Based on expenditure incurred

- House Rent Allowance (HRA)

- City Compensatory Allowance

- Entertainment Allowance

- Special Allowance – Travelling, Conveyance, Daily, Uniform, etc.

- Irrespective of expenditure incurred

- Hill area allowance

- Tribal area allowance

- Transport allowance

Chapter 6: Taxable Perquisites

Learning Objectives

6-1 Describe amenities and facilities provided by employer which attract tax

6-2 Illustrate Sweat equity and Employee Stock Options as perquisites and their tax incidence

Topics

- Furnished /Unfurnished accommodation with no rent/concessional rent charged

- Services of house help, attendant

- Supply of amenities (electricity, water, gas, etc.)

- Interest free loan or concessional loan

- Use of car and other movable assets

- Medical facility and club facility

- Employer’s contribution towards superannuation fund (above the exempt maximum limit)

- Value of specified security, sweat equity, Employee Stock Option Plan (ESOP) allotted/transferred to employee

- Tax of an employee paid by employer

Chapter 7: Income from House Property

Learning Objectives

7-1 Evaluate the income ascribed to a house property treated as investment

7-2 Calculate loss from a self-occupied house property built on borrowed capital

Topics

- The Basis of Charge

- The Basis of computing income from a let out house property

- Gross Annual Value (GAV) on the basis of Municipal Valuation (MV), Fair Rent (FR) and Standard Rent (SR)

- Net Annual Value (NAV)

- Standard Deduction under section 24(a) and Interest on borrowed capital u/s 24(b)

- Self-occupied house purchased/built on borrowed capital

Chapter 8: Income from Capital Gains

Learning Objectives

8-1 Categorize various capital assets on their respective norms of long-term holding

8-2 Identify capital assets where the benefit of indexation is not allowed

8-3 Determine cost of acquisition and holding period on transfer of capital assets acquired at no consideration

8-4 Assess capital gain on transfer/redemption of equity oriented and debt securities

Topics

- ‘Capital Asset’

- ‘Short-term’ and ‘Long-term’ capital asset

- Minimum period for different capital assets to become long-term capital assets

- Indexation benefit basis cost inflation index (CII) in respect of certain capital assets

- Capital assets transferred under a Gift, a Will, by succession/inheritance, etc. – Basis of cost of acquisition including improvement cost

- Fair Market Value for capital assets acquired before April 1, 2001

- Capital gain on transfer of land and building

- Self-generated capital assets (goodwill, business rights/permits/licenses, trade mark, brand, etc.

- Shares converted from debentures/bonds – basis of cost and period of holding

- Transfer of securities in Dematerialized form – FIFO basis of cost and period of holding

- Transfer of ESOP – cost of acquisition/consideration

- Capital gain (long-term) on transfer/redemption of equity shares of domestic companies and units of equity-oriented MF schemes w.e.f. April 1, 2018 (grandfathering provisions)

- Capital gain on buyback of shares

- Capital gain on transfer/redemption of debt securities and units of income/liquid MF schemes

- Tax on long-term/short-term capital gains where Securities Transaction Tax (STT) is paid

- Tax on long-term/short-term capital gains where STT is not paid

Chapter 9: Income from Other Sources

Learning Objectives

9-1 Categorize various receipts which have treatment of tax at marginal rates

9-2 Calculate the tax incidence the recipient has on gifts of cash/kind, movable and immovable assets

Topics

- Interest on Deposits (with banks, post office, companies, cooperative societies, etc.)

- Interest on loans

- Interest on securities, e.g. bonds, debentures, government securities, etc. (other than dividend from Indian companies)

- Dividends received by residents and ordinarily residents from non-domestic companies

- Gifts

- Gift of cash and kind exempt within prescribed limit

- Gift of movable assets above the prescribed limit

- Gift of immovable assets at inadequate consideration

- Winning from lotteries, horse races, card games, crossword puzzles, TV shows/contests, etc.

- Income from racing establishment

- Rental income on letting out plant, machinery, furniture and attached premises to such plant

- Advance money received and forfeited in the course of negotiations on transfer of a capital asset

- Income from undisclosed sources

Chapter 10: Income Exempt from Tax

Learning Objectives

10-1 Distinguish various income receipts exempt with their respective limits under rules

10-2 Analyze the exemption of Agricultural income and its evaluation on aggregate and net basis

10-3 Illustrate exemption admissible under house rent allowance in various conditions

Topics

- Agricultural Income (meaning and tax treatment)

- Family income received by a member of HUF

- Leave Travel Concession (LTC)

- Gratuity received by an employee on retirement or by dependents on death of employee (subject to rules)

- Commuted value of pension (subject to rules)

- Leave Encashment including on retirement (subject to rules)

- Voluntary retirement/separation compensation (subject to rules and limits)

- Life insurance policy proceeds1

- Amount received on maturity from Public Provident Fund, statutory Provident Fund, Sukanya Samriddhi Scheme

- House Rent Allowance (subject to rules and limits)

- Income of minor child (subject to limits)

- Dividends from domestic companies and Units of Mutual Fund schemes (on or after April 1, 2003, subject to limits w.e.f. April 1, 2018)

- Any amount received in a transaction of reverse mortgage (lump-sum or installments)

Chapter 11: Exemptions Available on Transfer of Long-term Capital Assets

Learning Objectives

11-1 Construct a scenario of availing exemption of long-term capital gains arising from transfer of house property

11-2Assess various situations to minimize long-term capital gains on transfer of other capital assets

11-3 Describe the stipulations/conditions to be maintained over various timelines if exemption of long-term capital gains availed

Topics

- Capital gains arising from transfer of residential property (long-term)

- In acquiring another housing property (in terms of Section 54)

- In acquiring Equity shares in an ‘eligible company’2 (in terms of Section 54GB) until March 31, 2021

- Capital gains deposit account scheme is utilized to park funds to be used in specified time limits

- Capital gains arising from transfer of any long-term capital asset

- In acquiring certain specified bonds3 (in terms of Section 54EC)

- In acquiring certain long-term specified assets4 (in terms of Section 54EE)

- In acquiring the first residential property (in terms of Section 54F)

Chapter 12: Permissible Deductions from Gross Total Income

Learning Objectives

12-1 Categorize deductions from gross total income and optimize them within overall limits

12-2 Evaluate deductions available with short-term and long-term commitments to reduce tax incidence within income constraints and financial goals

Topics

- Standard Deduction

- Professional Tax

- Employer contributions (forming part of Employee cost to company) to statutory and recognized Provident Funds, National Pension System (subject to approved limits)

- Approved investments, PF/NPS employee contributions, insurance premium, repayment of borrowed capital in housing loans, etc. (subject to limits of Section 80CCE)

- Additional contribution under NPS (subject to limits of Section 80CCD[1B])

- Interest on borrowed capital in housing loans (subject to limits of Section 24b)

- Medical Insurance premium (Section 80D)

- Medical treatment (Section 80DD/Section 80DDB)

- Approved Donations (Section 80G)Rent paid by self-employed individuals (subject to rules and limit under Section 80GG)

- Interest on deposits in savings bank account (subject to limit under Section 80TTA)

- Rebate under Section 87A

Chapter 13: Profits and Gains of Business or Profession

Learning Objectives

13-1 Describe businesses and their receipts with related principles for recognition

13-2 Understand allowances and specific deductions available to businesses

Topics

- Meaning of business, profession or vocation

- The basis of charge

- Business income, profits, compensation received, etc.

- Principles for arriving at business income

- Exclusions from business income

- MAT and AMT – Objectives, Provisions and Applicability

- Methods of Accounting

- Business allowances and deduction including specific deductions

- Depreciation allowance (methods, rates for different assets, set off and carry forward provisions)

- Expenditure in respect of specified businesses

- Amortization of preliminary expenses

- Interest on borrowed capital

- Contribution to approved gratuity fund, staff welfare fund, provident fund, NPS

- Bonus and Commission to employees

- Bad Debts

- Advertisement expenses

- Computation of professional income on estimated basis (Section 44ADA

- Multi-lateral Instruments (MLI) – Impact on Indian Tax Treaties

- Double Tax Avoidance Agreement (DTAA)

- General Anti Avoidance Rule (GAAR)

Chapter 14: Tax Treatment of Various Investments and Relative Advantage

Learning Objectives

14-1 Compare advantages of tax efficiency in certain investments within overall and goal specific risk constraints

14-2 Distinguish tax treatment meted out to unlisted securities, off-market transaction in listed securities and buyback of securities

14-3 Illustrate the impact on return from various investments due to dividend distribution tax

Topics

- Short-term and Long-term capital gains tax on listed Equity shares, equity oriented schemes of Mutual Funds, Index Funds, Equity Linked saving Schemes, Exchange Traded Funds (equity)

- Tax treatment of listed and unlisted shares – Bonus/Rights, Split/Consolidation, Mergers and Acquisitions

- Tax treatment of listed shares transacted in off-market

- Debt products – Various Bonds – Corporate, Zero-coupon, Tax-free, Convertible, Debentures, G-Secs, Mutual Funds debt schemes, FMP

- Masala Bonds, FCCB, Security Receipts, PTCs, GDRs and Warrants

- Tax Applicability on Stock Lending/Borrowing, Segregated portfolios of MFs, Winding up of MF schemes

- Sovereign Gold Bonds (SGB), tax advantage on maturity and secondary market transactions over bullion investment

- Taxability of Investment Instruments – EEE, EET and ETE

- Tax Aspects of AIFs, REITs and InvITs, Derivatives on Currency, Interest Rate and Commodities

- Tax Liability on Foreign Investments by NRIs and PIOs

Chapter 15: Various Other Provisions Available under Tax Laws

Learning Objectives

15-1 Explain various provisions under tax laws as well as certain requirements for effective discharge of tax statuses

15-2 Understand and interpret various set-off and carry forward of losses available under various heads as well as loss avoidance not available in dividend and bonus stripping

Topics

- Clubbing of Income

- Set off and carry forward of losses

- Business loss and depreciation

- Speculation loss

- Capital loss (rules for long-term and short-term set off)

- Loss from house property

- Loss on sale of shares/securities where dividend received (Section 94[7])

- Loss on sale of units of Mutual Fund where bonus units received (Section 94[8])

- Deduction and Collection of Tax on Source

- Tax Deducted at Source (TDS)

- Salaries, Fees on Professional and Technical Services

- Rents and Deposits

- Payment to Contractors/sub-contractors

- Winning from Lotteries, Races, Crossword Puzzles, TV shows/contests, etc.

- Withdrawal from provident funds within minimum prescribed period

- Tax Deducted at Source (TDS)

- Tax Collected at Source (TCS)

- Penalty in case of failure to deduct TDS/TCS

- Rounding off of taxable income

- Cash payment over a specified limit

Chapter 16: Computation of Taxable Income and Tax and Filing of Returns

Learning Objectives

16-1 Explain the process to arrive at taxable income and determine tax liability

16-2 Arrange ways to discharge tax liability estimated by way of self-assessment tax and periodical advance taxes

16-3 Understand nuances of timely filing tax return and the associated advantages and as well as pitfalls on default of filing return

16-4 Explain the circumstance where revised return needs to be filed

Topics

- Income from all sources

- Set off of losses – Current year and earlier years – Gross Total Income

- Admissible deductions – Net Income or Taxable Income

- Tax Liability – Income taxable at special rates and normal rates

- Tax as per slabs and applicable rates, surcharge and cesses

- Self-assessment tax

- Advance Tax – Due dates of filing and percentage limits of advance tax payable

- Who should file Returns?

- Exemption Limits for Resident, Senior Citizen and Super Senior Citizen

- Benefit of filing Return – Set off of carry forward losses, adjustment/refund of TDS amounts

- Appropriate Income Tax Return (ITR) Form

- Mode of submission (e-filing) and last due date

- Return filed beyond time – Penalty and other consequences

- Interest payable on default in furnishing return and default in payment of advance tax

- Revised Return

- Tax Refunds

FPSB Certification Code of Ethics (for all FPSB certifications)

FPSB LTD. CODE OF ETHICS

Observing the highest ethical and professional standards allows professionals to serve the interests of clients and promote the profession for the benefit of society. As part of their commitment, professionals should provide appropriate disclosures and comply with ethical standards when delivering advice to clients. FPSB has incorporated ethical behavior and judgment, and compliance with ethical standards, into its global standards for professionals. To ensure these obligations are understood, FPSB incorporates ethical standards into its certification requirements.

FPSB’s Code of Ethics Principles are statements expressing in general terms the ethical standards that professionals should adhere to in their professional activities. The comments following each Principle further explain the intent of the Principle. The Principles are aspirational and are intended to provide guidance for professionals on appropriate and acceptable professional behavior.

FPSB’s Code of Ethics Principles reflect professionals’ recognition of their responsibilities to clients, colleagues and employers. The Principles guide the performance and activities of anyone involved in the practice of advice; the concept and intent of these Principles are adapted and enforced on professionals by FPSB through rules of professional conduct.

Principle 1 – Client First

Place the client’s interests first

Placing the client’s interests first is a hallmark of professionalism, requiring the specialist to act honestly and not place personal gain or advantage before the client’s interests.

Principle 2 – Integrity

Provide professional services with integrity.

Integrity requires honesty and candor in all professional matters. Professionals are placed in positions of trust by clients, and the ultimate source of that trust is the specialist’s personal integrity. Allowance can be made for legitimate differences of opinion, but integrity cannot co-exist with deceit or subordination of one’s principles. Integrity requires the specialist to observe both the letter and the spirit of the Code of Ethics.

Principle 3 – Objectivity

Provide professional services objectively.

Objectivity requires intellectual honesty and impartiality. Regardless of the services delivered or the capacity in which a specialist functions, objectivity requires that professionals ensure the integrity of their work, manage conflicts of interest and exercise sound professional judgment.

Principle 4 – Fairness

Be fair and reasonable in all professional relationships. Disclose and manage conflicts of interest.

Fairness requires providing clients what they are due, owed or should expect from a professional relationship, and includes honesty and disclosure of material conflicts of interest. Fairness involves managing one’s own feelings, prejudices and desires to achieve a proper balance of interests. Fairness is treating others in the same manner that you would want to be treated.

Principle 5 – Professionalism

Act in a manner that demonstrates exemplary professional conduct.

Professionalism requires behaving with dignity and showing respect and courtesy to clients, fellow professionals, and others in business-related activities, and complying with appropriate rules, regulations and professional requirements. Professionalism requires the specialist, individually and in cooperation with peers, to enhance and maintain the profession’s public image and its ability to serve the public interest.

Principle 6 – Competence

Maintain the abilities, skills and knowledge necessary to provide professional services competently.

Competence requires obtaining and maintaining an adequate level of abilities, skills and knowledge in the provision of professional services. Competence also includes the wisdom to recognize one’s own limitations and when consultation with other professionals is appropriate or referral to other professionals necessary. Competence requires the specialist to make a continuing commitment to learning and professional improvement.

Principle 7 – Confidentiality

Protect the confidentiality of all client information.

Confidentiality requires that client information be protected and maintained in such a manner that allows access only to those who are authorized. A relationship of trust and confidence with the client can only be built on the understanding that the client’s information will not be disclosed inappropriately.

Principle 8 – Diligence

Provide professional services diligently.

Diligence requires fulfilling professional commitments in a timely and thorough manner and taking due care in delivering professional services.