Are you prepared for a top-tier educational experience provided by the Financial Planning Standards Board Ltd., the organization that sets standards for the financial planning profession globally? Available both online and through instructors like House of Financial Planners, FPSB Ltd.’s investment planning course equips you to enhance your clients’ investment strategies based on their risk profile, financial capacity and constraints.

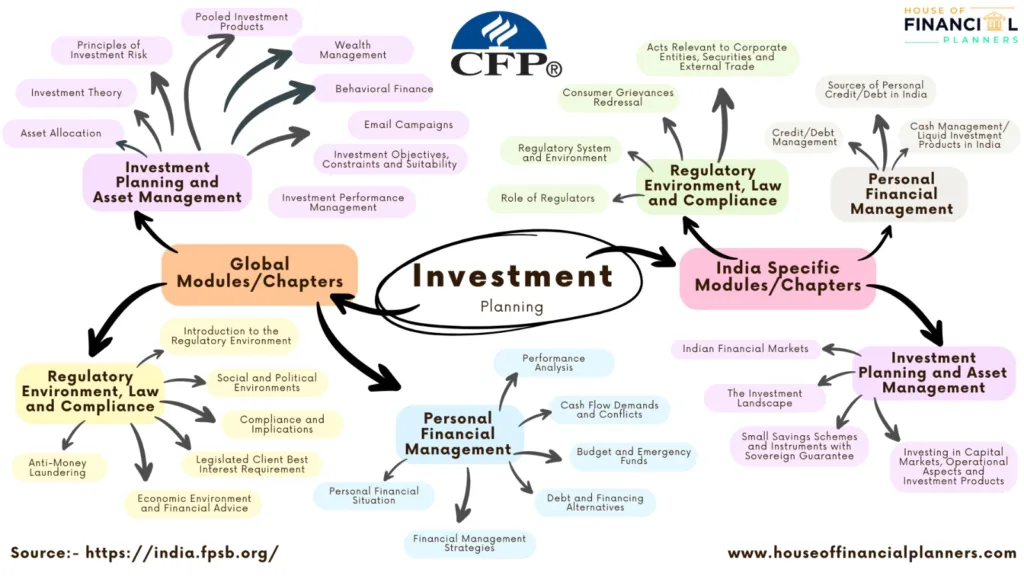

The course teaches you about different types of securities, investment theory and practice, portfolio construction and management, investment strategies and tactics, and securities laws and regulatory compliance. To be recognized by employers, clients, and the public for your knowledge and competency in investment planning, complete the roadmap below to obtain FPSB® Investment Planning Specialist certification in India.

About FPSB Ltd. and FPSB Programs in India

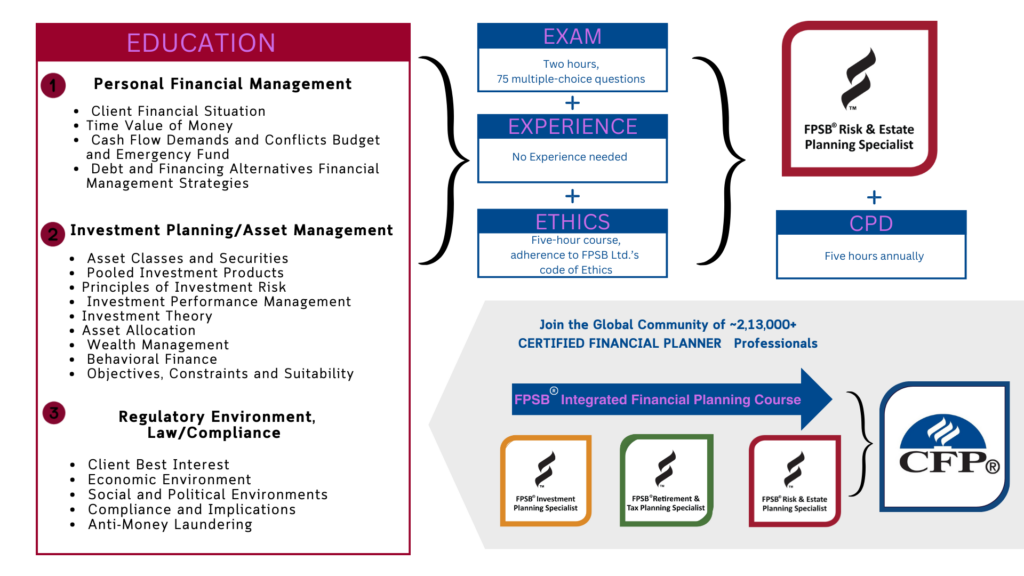

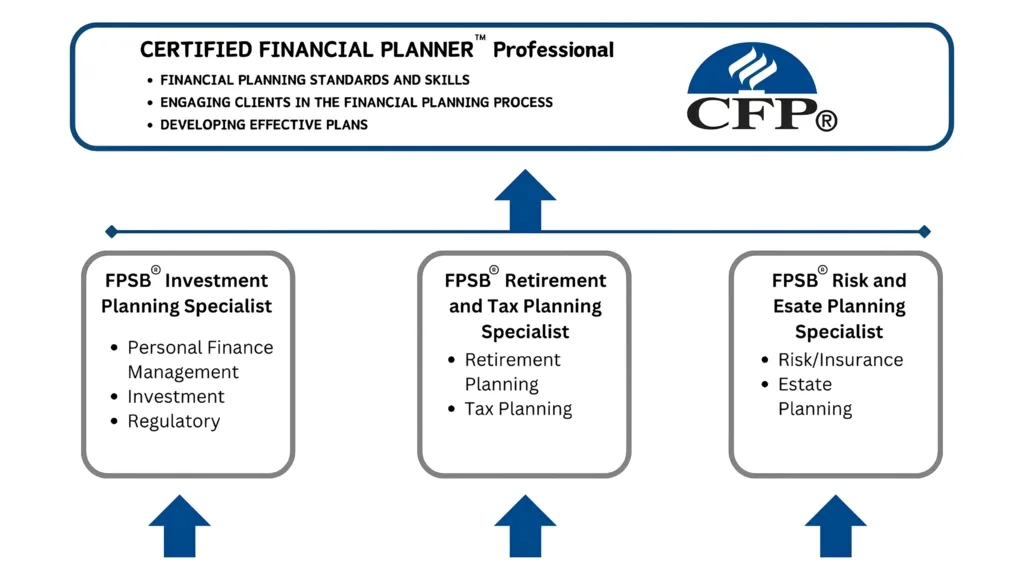

Financial Planning Standards Board Ltd. (FPSB) serves as the global authority for setting standards in financial planning and owns the CFPCM, CERTIFIED FINANCIAL PLANNERCM and , and marks outside the United States. FPSB is delighted to present its Investment Planning Specialist program, one of three pathways to CFP certification in India:

- FPSB® Investment Planning Specialist

- FPSB® Risk and Estate Planning Specialist

- FPSB® Retirement and Tax Planning Specialist

Each certification includes its unique coursework, examination, and credential. Notably, the courses for FPSB pathway certifications contribute to the educational requirements for CFPCM certification in India. Professionals interested in pursuing CFP certification can start by enrolling with FPSB and choosing any of the three pathway certifications, in any sequence. This document will concentrate on the FPSB Investment Planning Specialist certification.

FPSB® Investment Planning Specialist Overview

Take Your Career to the Next Level

Whether completed online or through an instructor like House of Financial Planners, the FPSB® Investment Planning Specialist course details methods for creating strategies and techniques aimed at maximizing a client’s investments, considering their risk profile, financial capacity, and constraints. This course is structured to deepen your understanding of various securities, investment theory and practice, the building and managing of portfolios, investment strategies and approaches, and adherence to securities laws and regulatory compliance.

Steps to Initial Certification

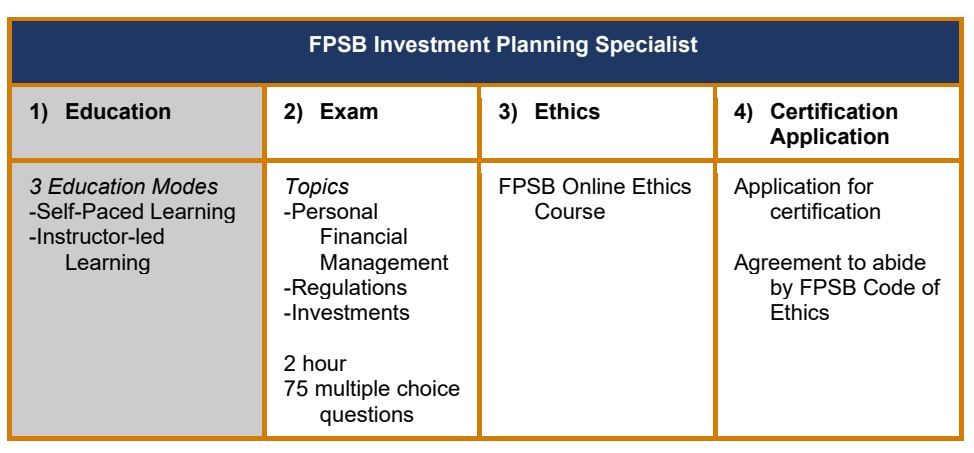

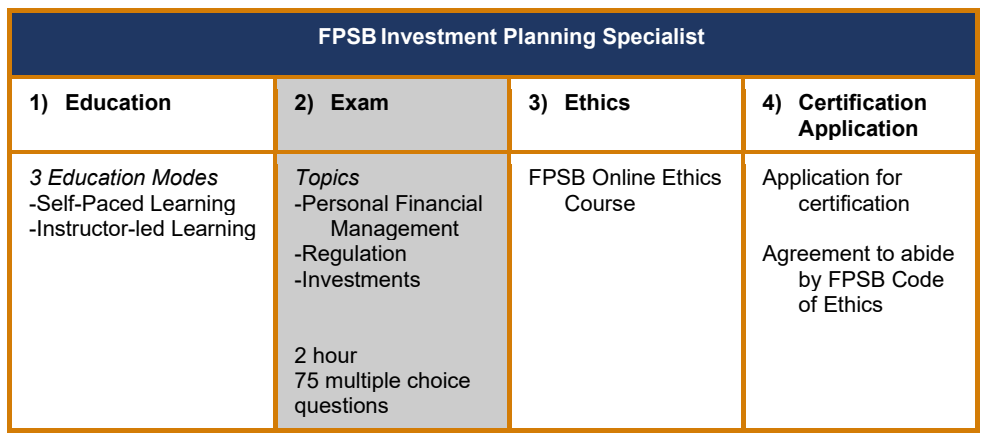

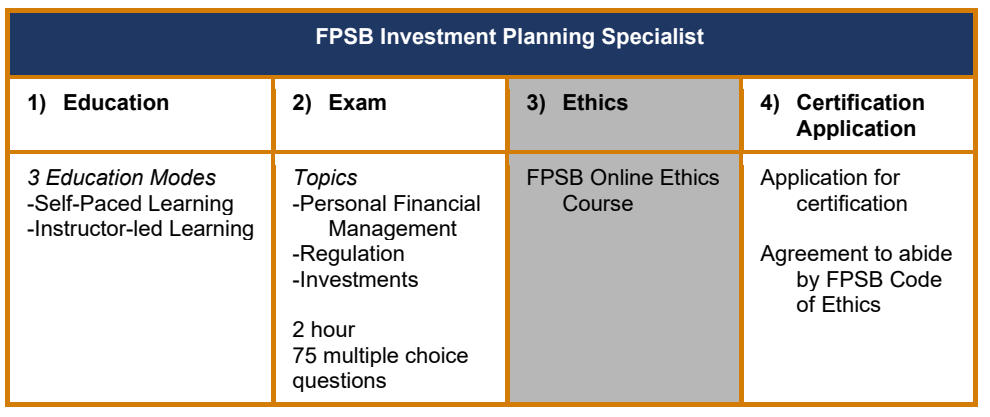

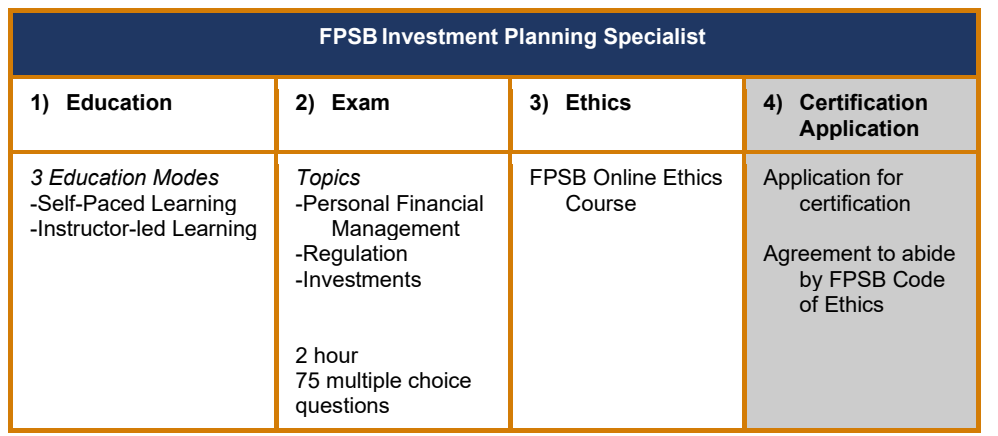

The requirements for FPSB Investment Planning Specialist certification are as follows:

- Successfully complete the FPSB Ltd. Ethics Course.

- Successfully complete FPSB’s education modules for

- Personal Financial Management

- Investment Planning and Asset Management

- Regulatory Environment, Law and Compliance

- Pass the FPSB Investment Planning Specialist exam, which aligns to the topics identified in the FPSB Investment Planning Specialist Competency Profile.

- Complete your certification application, which includes your agreement to comply with FPSB Ltd.’s Code of Ethics and payment of an annual certification fee.

Step 1: Education

Criteria to Register

Candidates must be at least 18 years old and have completed HSC/12th grade (Std XII/HSC) to register with FPSB and start the FPSB Investment Planning Specialist education course. It is required that candidates register with FPSB at least 30 days before registering for the exam.

Period for Course Completion

Individuals are required to finish the FPSB Investment Planning Specialist certification program within three years from their initial registration with FPSB Ltd. and must renew their registration annually. If the program is not completed within three years, FPSB Ltd. will deem the registration invalid. Candidates should evaluate their ability to complete the program within this timeframe before registering.

| Module | Name and Description |

| Personal Financial Management | The Personal Financial Management module provides an overview of how to evaluate and collect client information. Candidates will learn how to evaluate investment strategy options and develop financial management strategies based on a client’s unique situation. Candidates will learn how to develop an implementation plan that will provide the client an opportunity to meet his or her financial management goals and objectives. |

| Investment Planning and Asset Management | The Investment Planning and Asset Management module provides an overview of global and local economic institutions and other factors, such as the stock exchange, asset classes and securities, that impact investment planning as well as principles of investment risk. Candidates will learn various methods of computing expected returns from stocks, bonds and integrated portfolios, including investment risk and valuation ratios Through this module, Candidates will become familiar with the concepts of buying and selling securities, pooled investment products and behavioral finance, and learn how to interview clients to develop a personal risk profile. |

| Regulatory Environment, Compliance and Law | The Regulatory Environment module provides an overview of key foundational legislation and regulations. Through this module Candidates will become familiar with various regulatory bodies and varying economic, social and political environments. Other fundamental topics covered in the module include anti-money laundering and behavioral finance. |

FPSB Ltd. Educational Resources

FPSB Ltd. Will provide program participants with digital textbooks, supplementary post-chapter quizzes, post-module exams, and additional course materials via its online learning platform, MyFPSBlearning. All educational resources provided by FPSB Ltd. are tailored to the FPSB Investment Planning Specialist curriculum. Every candidate, irrespective of their chosen method of study, must acquire these materials.

Education

Candidates may complete the FPSB Investment Planning Specialist education requirement and become eligible to sit for the certification exam in one of three ways:

- Self-Paced Education

Candidates who enroll with FPSB and opt for “Self-Paced Learning” will be provided a password to access FPSB’s online learning platform, MyFPSBlearning. There, they can engage with various FPSB learning materials at their preferred pace and evaluate their understanding through quizzes and module tests, enhancing their learning experience. This self-directed educational path is particularly suitable for seasoned investment professionals or motivated individuals who prefer to study according to their own schedules.

*Self-paced learners who do not pass all FPSB Investment Planning Specialist module exams after the two attempts will be asked to pursue the instructor-led path by enrolling with an Authorized Education Provider (AEP). The House of Financial Planners is an authorized education provider of FPSB India.

2. Instructor-Led Education

Candidates seeking a comprehensive educational experience with interactive learning and access to an FPSB Authorized Education Provider should choose the “Instructor-Led Learning” option when registering with FPSB. FPSB Authorized Education Providers deliver both classroom and online learning experiences. Upon registering for instructor-led education with FPSB, individuals will be prompted to choose from among FPSB’s authorized providers, all of which are detailed on the FPSB Ltd. website.

Candidates who opt for FPSB’s instructor-led education can expect to receive the below teaching hours per module.

Step 2. Exam

Upon successfully completing the FPSB Investment Planning Specialist education requirement, either through an FPSB instructor-led course or a self-paced education program, candidates will qualify to take the FPSB Investment Planning Specialist exam.

This exam evaluates the depth of knowledge, skills, and abilities required to obtain the FPSB Investment Planning Specialist credential. It includes tasks such as collection, analysis, and synthesis, which are explained in more detail below. Each question in the exam is mainly based on a specific competency from the FPSB Investment Planning Specialist Competency Profile and may involve combining several competencies to provide a comprehensive assessment.

Exam Overview

- 75 multiple-choice questions (4 possible answer choices), of which a minimum of 65 questions are potentially scored and up to 10 questions are used to develop future exams.

- Computer-based testing format

- Duration – two hours

- Financial calculators permitted (data must be erased)

- There will be two possible marks: correct, with points allotted; or incorrect, for zero points. Candidates will not have points deducted (referred to as ‘negative marking’)

Exam Scoring

- The passing point on the FPSB® Investment Planning Specialist exam is set to a level that is what is required for competent practice. Once set, future exams are equated to this same level so that candidates who take the exam one month have the same opportunity to demonstrate their abilities as candidates who take the exam a different month. The level of ability is what is consistent. This means that even if one exam is harder than another, the equating process gives every candidate the same opportunity to pass.

Areas of Practice

The exam will test the following areas of practice, which are also described to in more detail in the FPSB Investment Planning Specialist Competency Profile.

| FPSB Investment Planning Specialist Global Areas of Practice | ||

| Personal Financial Management | Investment Planning and Asset Management | Regulatory Environment, Law and Compliance |

| Personal Financial Situation | Investment Objectives, Constraints and Suitability | Introduction to the Regulatory Environment |

| Cash Flow Demands and Conflicts | Asset Classes and Securities | Legislated ‘Client Best Interest’ Requirement |

| Budget and Emergency Funds | Pooled Investment Products | Economic Environment and Financial Advice |

| Debt and Financing Alternatives | Principles of Investment Risk | Social and Political Environments |

| Financial Management Strategies | Investment Performance Management | Compliance and Implications |

| Time Value of Money | Investment Theory | Anti-Money Laundering |

| Asset Allocation | ||

| Wealth Management | ||

| Behavioral Finance | ||

| FPSB Investment Planning Specialist India Specific Areas of Practice | ||

| Personal Financial Management | Investment Planning and Asset Management | Regulatory Environment, Law and Compliance |

| Cash Management/ Liquid Investment Products in India | Indian Financial Markets | Regulatory System and Environment |

| Sources of Personal Credit/Debt in India | The Investment Landscape | Role of Regulators |

| Credit/Debt Management | Investing in Capital Markets, Operational Aspects and Investment Products | Acts Relevant to Corporate Entities, Securities and External Trade |

| Small Savings Schemes and Instruments with Sovereign Guarantee | Consumer Grievances Redressal | |

| Investing in Fixed Income Securities | Other Acts, Statutes and Regulations Relevant to Financial Consumers | |

| Evaluation of Ecosystem and Client Sensitivity in Managing Situations | Regulation of Market Intermediaries in Financial Products | |

| Financial Advisory and Financial Planning | ||

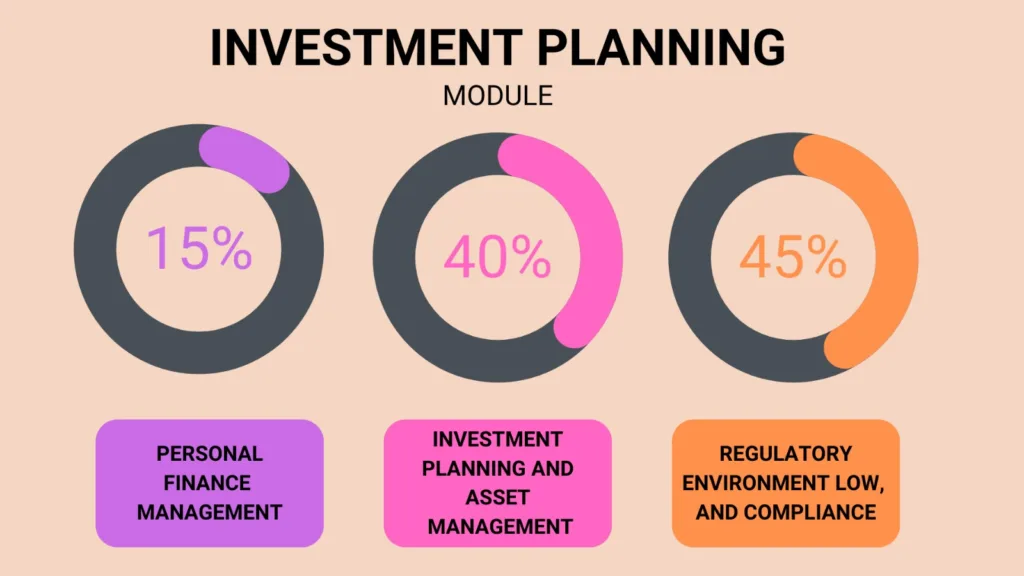

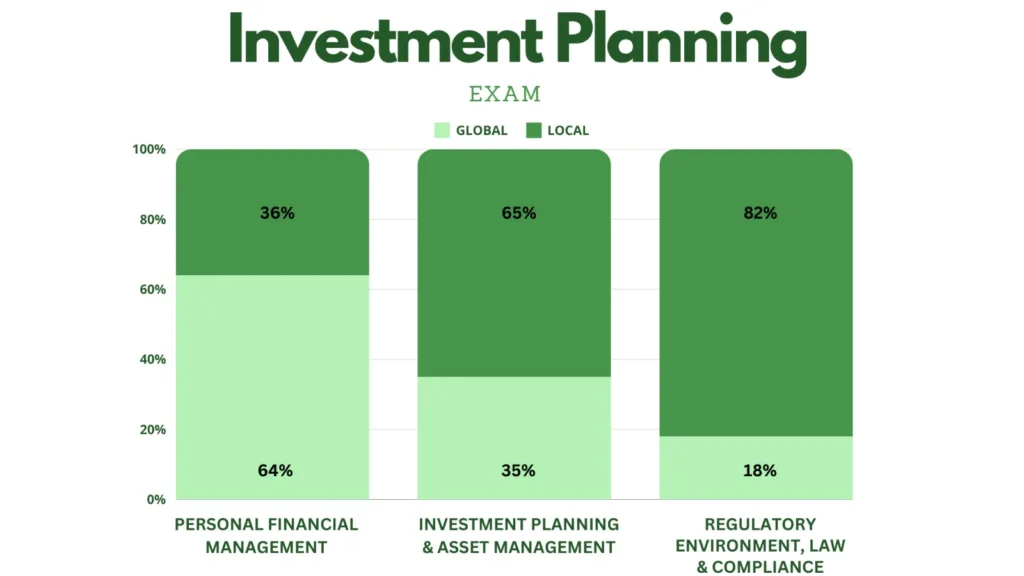

The FPSB Investment Planning Specialist exam will test the knowledge, skills and abilities from the FPSB Investment Planning specialist education modules in the below proportions. However, there will not be specific sections allocated to the modules. Instead, questions relating to each module will appear in no specific order throughout the exam.

Likewise, although the FPSB Investment Planning Specialist textbooks draw a distinction between “global” and “India-specific” education content, exam questions will not be specifically identified as such, and will appear in no specific order throughout the exam.

Difficulty Levels

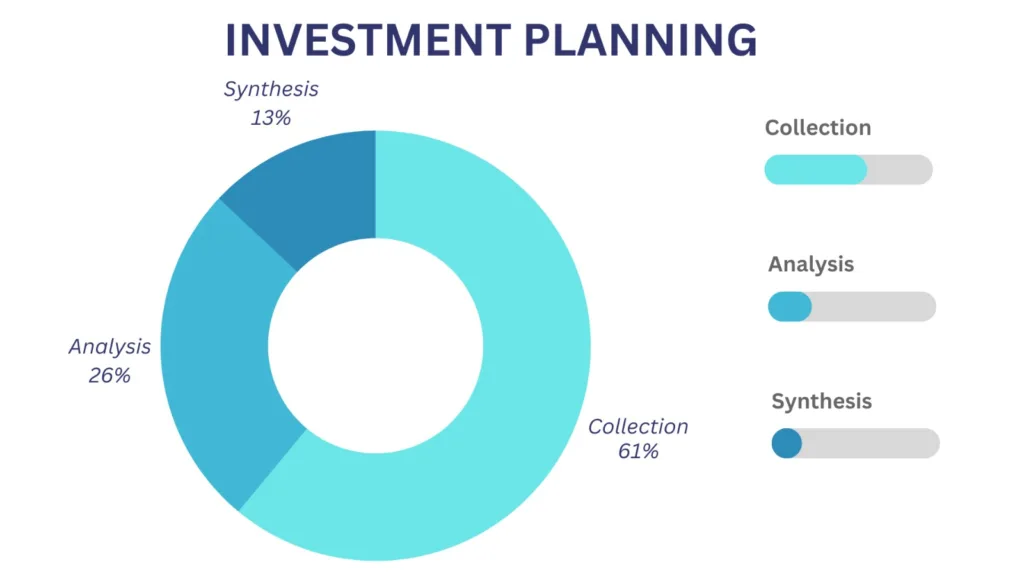

The FPSB Investment Planning Specialist certification exam is designed to assess knowledge, skills and abilities in the areas of collection, analysis, and synthesis in approximately the following proportions:

- Collection: Gathering information and identifying related facts by making required calculations and arranging client information for analysis. During the collection function, the core competency is to collect both the quantitative and qualitative information required to provide investment advice.

- Analysis: considers issues, performs financial analysis and assesses the resulting information to be able to develop strategies for the client. This includes: (1) considering potential opportunities and constraints in developing strategies, and (2) assessing information to develop strategies.

- Synthesis: integrates the information needed to develop and evaluate strategies to create an investment plan.

Appeal Process

Candidates may choose to appeal the results of an exam by submitting a request at https://india.fpsb.org/product/india-cfp-exam-evaluation/.

Once submitted, exam results will be reviewed in detail and the Candidate will receive additional determination information. Any appeal must be received no later than 30 days from the intimation of the exam result in LMS or through email. The decision after the appeal is completed will be considered final.

Step 3. Ethics

FPSB requires all individuals complete the FPSB Ethics course shortly after enrolling in the Investment Planning Specialist course. This course, included with the purchase of course materials, is essential as passing it and adhering to the Code of Ethics are prerequisites for obtaining the Investment Planning Specialist certification. The requirement to pass the Ethics course applies only once, even if pursuing multiple Specialist certifications and the CFPCM certification. Conducted online via MyFPSBlearning, the FPSB Ethics Course features interactive, recorded lessons that can be completed in one or several sessions, with periodic knowledge assessments. Once finished, this course fulfills the ethics training requirement for all FPSB Ltd. certifications available in India.

Ethics Attestation

After candidates have passed the FPSB Ethic Course, they must, as part of the FPSB Investment Planning Specialist certification process, attest and agree to abide by the FPSB Code of Ethics.

| Introduction | Codes of Ethics |

| Learning Objectives 1. Explain why financial services professionals should study ethics 2. Describe the difference between values and principles 3. Describe the relationship between ethics and the law 4. Describe a financial services professional 5. Identify characteristics of a professional 6. Evaluate the public perception of the financial services profession Knowledge Items 1. Why financial services professionals should study ethics 2. The difference between values and principles 3. Ethics and the law 4. Characteristics of a financial services professional 5. Public perception of the financial services profession | Learning Objectives 1. Identify the purposes of codes of ethics 2. Distinguish between the reasonable person standard and the professional practice standard 3. Identify the eight principles of FPSB’s Code of Ethics 4. Apply the principles of FPSB’s Code of Ethics to various case studies and examples 5. Construct a personal code of ethics Knowledge Items 1. The purpose of a code of ethics 2. Business conduct standards 3. Reasonable person standard 4. Professional practice standard 5. Eight principles of FPSB’s Code of Ethics 6. Personal code of ethics |

Step 4: Initial and Ongoing Certification

Ongoing FPSB Investment Planning Specialist Certification Requirements

To maintain the right to use the FPSB Investment Planning Specialist credential, certification holders must maintain their professional skills, knowledge, and abilities through ongoing learning activities.

FPSB Ltd. requires FPSB Investment Planning Specialists to renew their certification annually. To remain certified as an FPSB Investment Planning Specialist certification holders must:

✔ Commit to adhere to FPSB Ltd.’s Code of Ethics and any applicable laws and regulations.

✔ Obtain at least five Continuing Professional Development (CPD) hours/points. All points must be completed before applying for renewal of certification. At least two CPD

hours/points need to directly relate to FPSB Ltd.’s Code of Ethics.

FPSB Coursework as Continuing Professional Development

FPSB Investment Planning Specialists who pursue other Specialist courses are considered to have met their annual CPD requirement through the coursework for FPSB’s other certifications – as proven by registration in the FPSB Risk and Estate Planning Specialist, FPSB Retirement and Tax Planning Specialist, or CFPCM certification programs.

Using your Badge and Certification Name Correctly

FPSB will post guidance on how to correctly identify yourself as an FPSB Investment Planning Specialist. All certification holders will be required to abide by the guidance as part of the FPSB Code of Ethics.

FPSB Investment Planning Specialist Competency Profile

Module IA. Global Personal Financial Management

Chapter 1: Personal Financial Situation

Learning Objectives

1-1 Identify the types of information to collect regarding a client’s assets and liabilities

1-2 Evaluate whether a client is living within financial means

Knowledge Items

1.1 Living within financial means

1.1.1 Statement of financial position – Balance sheet

1.2 Assets

1.3 Liabilities

1.3.1 Net worth

Chapter 2: Cash Flow Demands and Conflicts

Learning Objectives

2-1 Identify the types of information to collect regarding a client’s cash flow and financial obligations

2-2 Identify types of conflicting demands on cash flow

Knowledge Items

2.1 Cash flow statement

2.2 Conflicting demands

Chapter 3: Budget and Emergency Fund

Learning Objectives

3-1 Identify the types of information to collect to prepare a client’s budget

3-2 Describe how to prepare statements of a client’s net worth, cash flow and budget

3-3 Determine a client’s ability to save

3-4 Analyze the adequacy of a client’s emergency fund

Knowledge Items

3.1 Budget creation and evaluation

3.1.1 Special needs and goals

3.2 Types of Budgets

3.2.1 Financial ratios

3.3 Emergency fund and funding vehicles

3.4 Building cash reserves

3.5 Income generation

Chapter 4: Debt and Financing Alternatives

Learning Objectives

4-1 Evaluate the implications of a client’s attitude toward debt

4-2 Identify types of credit

4-3 Analyze financing alternatives

Knowledge Items

4.1 Credit use and potential problems

4.2 Mortgages and other installment loans

4.3 Revolving credit

4.4 Leasing versus buying

Chapter 5: Financial Management Strategies

Learning Objectives

5-1 Determine potential financial management strategies for a client

5-2 Identify the advantages and disadvantages of financial management strategies

5-3 Optimize financial management strategies to make recommendations

5-4 Prioritize action steps to assist a client in implementing financial management strategies

Knowledge Items

5.1 Developing and optimizing financial management strategies

5.2 Implementing financial management strategies with a client

Chapter 6: Time Value of Money

Learning Objectives

6-1 Describe the impact of rate assumptions on goal achievement

6-2 Calculate the present value of a single sum or payment

6-3 Calculate the future value of a single sum or payment

6-4 Calculate the interest rate or compounding period

6-5 Calculate the periodic payment

6-6 Calculate the present value for an inflation-adjusted (serial) payment

6-7 Calculate the inflation-adjusted (serial) payment for a future sum

6-8 Calculate the present value or internal rate of return of unequal cash flows

Knowledge Items

6.1 Time value of money (TMV) concepts and assumptions

6.1.1Solving time value of money problems

6.2 Basic time value of money calculations

6.2.1 Capitalization of a number

6.2.2 Present value of a single sum

6.2.3 Future value of a single sum

6.2.4 Number of compounding periods and interest rate per compounding period

6.2.5 Present value of an annuity

6.2.6 Future value of an annuity

6.2.7 Periodic payment or receipt

6.3 Intermediate time value of money calculations

6.3.1 Inflation and serial payments

6.3.2 Present value of an annuity due (PVAD) of a serial payment

6.3.3 Serial payment for a future sum

6.4 Advanced time value of money calculations

6.4.1 Internal rate of return with unequal cash flows

6.4.2 Net present value calculation with unequal cash flow

Module IB. India-Specific Personal Financial Management

Chapter 1: Cash Management/ Liquid Investment Products in India

Learning Objectives

1-1 Identify types of cash management and liquid products in India

Topics

1.1 Savings bank account, Recurring Deposit and Fixed Deposit with graded maturity profile

1.2 Corporate Deposit, Post Office Term Deposit

1.3 Ultra-Short duration fund, low duration fund, Liquid scheme, Money Market Mutual Fund

Chapter 2: Sources of Personal Credit/Debt in India

Learning Objectives

2-1 Compare different sources from which to borrow funds

2-2 Identify types of credit

Topics

2.1 Structured Lending Institutions

2.1.1Public Sector and Private Sector Banks, Small Banks, Co-operative Banks, Regional Rural Banks, Payment Banks

2.1.2 Financial Institutions, State Financial Corporations

2.1.3 Non-banking Financial Companies (NBFC), Housing Finance Companies, Gold Finance Companies, Micro-Finance Institutions

2.2 Unregulated lending

2.2.1 Moneylenders

2.2.2 Chit Funds

2.2.3Cooperative Credit Societies

2.3 Others

2.3.1 Loans and Advances from Employer

Chapter 3: Credit/Debt Management

Learning Objectives

3-1 Identify nature and types of debt

3-2 Explain CIBIL score and purpose

3-3 Understand types of loans to suit purpose and tenure

3-4 Analyze debt and financing alternatives

Topics

3.1 Nature and Types of Debt, Productive and Unproductive Debt

3.2 CIBIL1 Score

3.2.1 CIBIL collects and maintains credit records of individuals as well as commercial entities

3.2.2 Banks/NBFCs access CIBIL score to ascertain creditworthiness of individuals

3.2.3 Tracks Debt repayment history, Credit limit utilization/enhancement, disputes, repayment capacity, etc.

3.3 Types of Loans to finance varied goals

3.3.1Consumer Loan, personal Loan, Credit Card Debt, Vehicle Loan

3.3.2 Mortgage, Fixed Rate vs. Variable Rate

3.3.3 MIBOR2, MCLR3 in determining interest level

3.3.4 Loan against Property or Securities, Gold loan, Gold Monetization scheme

3.3.5 Reverse Mortgage

3.4 Using the right credit to finance goals

3.5 Analysis of Debt and Financing Alternatives

3.5.1 Loan Repayment Schedules

3.5.2 Refinancing – Loan Restructuring, Present value of future payments

3.5.3 Varying Interest Rates – Fixed EMI vs. Fixed Tenure, Option of Bullet payments

3.5.4 Hire purchase

Module IIA. Global Investment Planning and Asset Management

Chapter 1: Investment Objectives, Constraints and Suitability

Learning Objectives

1-1 Describe the steps of the initial client interview process

1-2 Explain the characteristics of various investor personality types

1-3 Identify the types of information to collect from a new client

1-4 Identify factors that affect a client’s risk tolerance

1-5 Identify a client’s potential tax issues

1-6 Describe the characteristics of a client’s financial life stages

1-7 Describe the characteristics of a well-defined investment goal

1-8 Describe common categories of investment objectives

1-9 Explain the primary purpose of an Investment Policy Statement (IPS)

1-10 Identify components of an Investment Policy Statement (IPS)

Knowledge Items

1.1 Engaging investment clients

1.1.1The initial client interview

1.1.2 Discovery process

1.1.3Investor personalities

1.1.4 Gathering client data

1.2 Risk tolerance and suitability

1.2.1 Determining investor risk tolerance

1.2.2 Risk tolerance questionnaires

1.2.3Suitability using risk tolerance information

1.2.4 Matching return expectations with risk tolerance

1.2.5 Risk-return application

1.3 Potential tax issues

1.3.1 Taxability of a portfolio

1.3.2 Effect of selling property

1.3.3Real property

1.3.4 Capital assets gains and losses

1.3.5 Good record-keeping

1.4 Understanding life stages

1.5 Establishing goals and timelines

1.5.1 SMART goals

1.6 Defining and determining investment objectives

1.6.1 Inappropriate portfolio assets

1.6.2 Portfolio proposal

1.7 Investment Policy Statement (IPS)

1.7.1 Putting the pieces on paper

1.7.2 Advisor as investment manager

1.7.3 Advisor as investment intermediary

1.7.4 The value of advisor monitoring and follow-up

Chapter 2: Asset Classes and Securities

Learning Objectives

2-1 Describe the characteristics of common stock

2-2Explain the purpose of an Initial Public Offering (IPO)

2-3 Explain dividends

2-4 Calculate the dividend payout ratio

2-5 Explain key dates associated with stock dividend payouts

2-6 Explain stock splits and reverse stock splits

2-7 Explain why a company would use a stock split or reverse stock split

2-8 Calculate the intrinsic value of a dividend-paying stock using the dividend discount model

2-9 Describe alternative valuation methods for stocks that do not pay a dividend

2-10 Describe the characteristics of a bond

2-11 Identify the types of bonds issued by various entities

2-12 Calculate a bond’s current price/value

2-13 Describe the characteristics of preferred stock

2-14 Calculate the inherent value of preferred stock using the zero-growth model

2-15 Describe the advantages and disadvantages of owning real estate

2-16 Calculate the value of income-producing real estate using the net income method

2-17 Identify strategies used to employ call and put options

2-18 Explain structured products

2-19 Explain how futures contracts are used to hedge a long or short position

2-20 Explain alternative investments

Knowledge Items

2.1 Equity/common stock

2.1.1 Capitalization of a business

2.1.2 Rights

2.1.3 Initial Public Offering (IPO)

2.2 Buying and selling securities

2.2.1 Primary market

2.2.2 Secondary market

2.2.3 Third market

2.2.4Fourth market

2.2.5 Types of orders

2.3 Types of return from common stock

2.3.1Dividends

2.3.2 Stock splits

2.3.3 Equity valuation methods

2.3.4 Additional valuation ratios

2.4 Fixed income securities

2.4.1 Cash and equivalents

2.4.2 Bonds

2.4.3 Types of bonds and issuers

2.4.4 Bond risks and returns

2.4.5 Buying and selling bonds

2.4.6 Bond yields

2.4.7 Bond price / valuation calculations

2.4.8 Duration and immunization

2.4.9Convexity

2.4.10 Bond portfolio examples

2.4.11 Yield curve and risk-free rate of return

2.5 Preferred stock

2.5.1 Preferred stock valuation (zero-growth model)

2.6 Real assets

2.6.1 Real estate (and taxation)

2.6.2 Considerations of real estate ownership

2.6.3Forms of real estate ownership

2.6.4 Valuation of income producing property

2.6.5 Real assets and collectibles

2.7 Derivatives

2.7.1 Options contracts, key terms, rights and obligations

2.7.2 Options strategies

2.7.3 Structured products/market-linked securities

2.8 Commodities

2.8.1 Futures and forward contracts

2.9 Alternative investments

2.9.1Venture capital

2.9.2 Private equity

2.9.3 Hedge funds

Chapter 3: Pooled Investment Products

Learning Objectives

3-1 Describe the characteristics of mutual funds

3-2 Identify the advantages and disadvantages of mutual funds

3-3 Describe the characteristics of closed-end funds

3-4 Identify the advantages and disadvantages of closed-end funds

3-5 Describe the characteristics of Exchange-Traded Funds (ETFs)

3-6 Identify the advantages and disadvantages of Exchange-Traded Funds (ETFs)

3-7 Describe the characteristics of Exchange-Traded Notes (ETNs)

3-8 Identify the advantages and disadvantages of Exchange-Traded Notes (ETNs)

3-9 Describe the characteristics of Unit Investment Trusts (UITs)

3-10 Identify the advantages and disadvantages of Unit Investment Trusts (UITs)

3-11 Describe the characteristics of managed accounts

3-12 Identify the advantages and disadvantages of managed accounts

3-13 Explain key considerations when evaluating and selecting pooled investment products

Knowledge Items

3.1 Mutual funds

3.1.1Characteristics

3.1.2 Advantages of mutual funds

3.1.3Disadvantages of mutual funds

3.1.4The fund prospectus

3.1.5 Fund reporting

3.1.6 The name game and types of mutual funds

3.1.7 Purchasing strategies

3.2 Closed-end funds

3.2.1 Characteristics, advantages and disadvantages

3.3 Exchange Traded Funds (ETFs)

3.3.1 Characteristics, advantages and disadvantages

3.4 Exchange Traded Notes (ETNs)

3.4.1 Characteristics, advantages and disadvantages

3.5 Unit Investment Trusts (UITs)

3.5.1 Characteristics, advantages and disadvantages

3.6 Managed accounts

3.6.1 Characteristics, advantages and disadvantages

3.7 Considerations in investment product analysis/selection

3.7.1 Fund comparison

3.7.2 Manager discretion

3.7.3 Total costs

3.7.4 Turnover

3.7.5 Individual securities versus pooled holdings

Chapter 4: Principles of Investment Risk

Learning Objectives

4-1 Explain the various sources of systematic investment risk

4-2 Explain the various sources of nonsystematic investment risk

4-3 Calculate the standard deviation of a single asset

4-4 Calculate the standard deviation of a two-asset portfolio

4-5 Explain covariance and its main limitation

4-6 Explain how correlation coefficient is used in the construction of investment portfolios

4-7 Analyze the correlation coefficient between two different assets

4-8 Analyze the coefficient of determination

4-9 Analyze beta

4-10 Evaluate the uses of beta in security selection/risk measurement

Knowledge Items

4.1 Total risk

4.1.1 Types of investment-related risk

4.1.2 Systematic risk

4.1.3 Nonsystematic risk

4.2 Risk measurements

4.2.1 Standard deviation

4.2.2 Covariance

4.2.3 Correlation coefficient (R)

4.2.4 Coefficient of determination

4.2.5 Beta

Chapter 5: Investment Performance Management

Learning Objectives

5-1 Compare and contrast measures of return: weighted average, time-weighted, dollar- weighted, holding period

5-2 Apply Sharpe Ratio to measure risk-adjusted return

5-3 Apply Sharpe Ratio to make fund comparisons

5-4 Apply Treynor Ratio to measure risk-adjusted return

5-5 Apply Treynor Ratio to make fund comparisons

5-6 Apply Jensen Index to measure risk-adjusted return

5-7 Describe methods of constructing market benchmarks

5-8 Describe the primary approaches to fundamental analysis

5-9 Identify the basic assumptions of technical analysis

5-10 Evaluate the rules of contrarian investing

Knowledge Items

5.1 Types and measures of return

5.2 Evaluating performance

5.2.1 Weighted-average return

5.2.2 Time-weighted return

5.2.3 Dollar-weighted return

5.2.4 Holding-period return

5.3 Assessing/comparing performance

5.3.1 Sharpe Ratio

5.3.2 Treynor Ratio

5.3.3 Jensen’s Index / Alpha

5.3.4 Benchmark construction and comparisons

5.3.5 Application of performance measures

5.4 Historical returns by asset class

5.5 Fundamental analysis

5.5.1 Top-down analysis

5.5.2 Bottom-up analysis

5.6 Technical analysis

5.6.1 General assumptions of technical analysis

5.6.2 Contrarian investing rules/strategies

5.6.3 Price and volume based rules

Chapter 6: Investment Theory

Learning Objectives

6-1 Explain the assumptions of Modern Portfolio Theory (MPT)

6-2 Explain how Modern Portfolio Theory (MPT) is used to evaluate and construct client portfolios

6-3 Explain the concept of optimal portfolio

6-4 Calculate the required rate of return using the Capital Asset Pricing Model (CAPM)

6-5 Illustrate the three forms of the Efficient Market Hypothesis (EMH)

Knowledge Items

6.1 Modern Portfolio Theory (MPT)

6.1.1 Assumptions

6.1.2 The efficient frontier and optimal portfolios

6.1.3 Capital Asset Pricing Model (CAPM)

6.1.3.1 Capital market line

6.1.3.2Security market line

6.2 Arbitrage pricing theory

6.3 Efficient Market Hypothesis (EMH)

6.4 Random walk theory

Chapter 7: Asset Allocation

Learning Objectives

7-1 Identify the advantages and disadvantages of asset allocation strategies

7-2Identify the advantages and disadvantages of asset rebalancing strategies

7-3 Identify the advantages and disadvantages of active and passive asset management strategies

Knowledge Items

7.1 Asset allocation

7.1.1 Strategic allocation

7.1.2 Tactical allocation

7.1.3 Dynamic allocation

7.1.4 Core/satellite allocation

7.1.4.1 Asset allocation process

7.1.4.2 Asset classes and individual securities

7.2 Rebalancing strategies

7.2.1 Time-based

7.2.2Threshold-based

7.2.3 Time-and threshold-based

7.3 Active management

7.3.1 Passive management

7.3.2 Designing a portfolio

Chapter 8: Wealth Management

Learning Objectives

8-1 Evaluate implications of concentration of a client’s investment holdings

8-2 Evaluate strategies to address a concentrated position

8-3 Analyze a company’s financial statements

8-4 Evaluate alternative investments for inclusion in a client’s portfolio

8-5 Describe the characteristics of venture capital

8-6 Describe the characteristics of private equity

8-7 Describe the characteristics of hedge funds

8-8 Describe the characteristics of managed futures

8-9 Describe the characteristics of private banking services

Knowledge Items

8.1 Wealth management process

8.2 Executive stock options

8.3 Concentrated stock positions

8.3.1 Concentrated stock definitions and risks

8.3.2 Options to address

8.4 Corporate finance / financial statement analysis

8.4.1 Liquidity ratios

8.4.2 Activity ratios

8.4.3 Profitability ratios

8.5 Alternative investments for high net worth individuals

8.5.1 Managed futures

8.6 Private banking

8.6.1 Private banking versus wealth management

8.6.2 Private banking services

Chapter 9: Behavioral Finance

Learning Objectives

9-1 Describe a client’s behavioral, information processing, and emotional biases

9-2 Explain the theories of how money makes clients think and behave

9-3 Describe methods to help clients “behave” their way to success

Knowledge Items

9.1 Behavioral biases

9.1.1 Cognitive dissonance

9.1.2 Conservatism

9.1.3 Confirmation

9.1.4Representativeness

9.1.5 Illusion of control

9.1.6 Hindsight

9.2 Information processing biases

9.2.1 Anchoring and adjustment

9.2.2 Mental accounting

9.2.3 Framing

9.2.4 Availability

9.2.5 Ambiguity aversion

9.2.6 Self-attribution

9.2.7 Outcome

9.2.8 Recency

9.3 Emotional biases

9.3.1 Loss aversion

9.3.2 Overconfidence

9.3.3Optimism

9.3.4 Self-control

9.3.5 Status quo

9.3.6 Endowment

9.3.7 Regret aversion

9.4 The psychology of money

9.5 Choice architecture

Module IIB. India-Specific Investment Planning and Asset Management

Chapter 1: Introduction to Indian Financial Markets

Learning Objectives

1-1 Understand the Indian economy and structures

1-2 Describe the securities market and the key players

Topics

- The Indian Economy

- Market Infrastructure Institutions

- Reserve Bank of India – The Central Bank

- Securities and Exchange Board of India

- Structure of Financial Market in India

- Money Markets

- The Securities Markets – Structure and Key Players

- Securities and Types of Securities

- Types of Securities Markets

- Key Players in Securities Markets

- Role of Participants in Securities markets

- Primary Market

- Functions of Primary Market Intermediaries in Primary Market

- Investment Banks, Lead Managers and Registrars

- Types of Issues – Public and Preferential (IPO, FPO, Rights, Bonus)

- Types of Placements – Equity and Debt (Private Placement, QIP)

- Public Issue of Debt Securities

- Pricing of a Public Issues of shares – Regulatory Norms

- Secondary Market

- Functions of Secondary Market Exchange Infrastructure Clearing and Settlement

- Clearing Corporation, Clearing Members and Clearing Bank

- Custodian

- Depositories and Depository Participants Stockbrokers and Traders

- Credit Rating Agencies and Credit Bureaus Registrar and Transfer Agents

- KYC Registration Agencies

- Major Stock Exchanges – Stock Indices – Basis and Composition Market information – Capitalization, Turnover and Total Return Index

Chapter 2: The Investment Landscape

Learning Objectives

2-1 Explain varying markets and key players

2-2 Distinguish the investment landscape

Topics

- Categories of Issuers

- Central and State Governments

- Private Sector Companies

- Banks, NBFCs and Financial institutions

- Mutual Funds

- REITs and InvITs

- Alternative Investment Funds (AIFs)

- Equity Markets

- Role played by different investors in the market (Retail, HNWIs, DIIs,FPIs)

- Shareholding Pattern – What does it indicate?

- Investment in Equity – Shareholders’ Rights

- Equity Derivatives Market – Indicators and Pricing Mechanism

- Futures and Options

- Costs, Benefits and Risk of Derivatives

- Index Futures vs Index Options vs Index Funds

- Debt Markets

- Depth of Debt Markets and Key Players

- Types of Debt and Fixed Income Instruments

- Trading in Various Debt Products

- Commodities Markets

- Structure, Exchanges and Regulation

- Commodities Futures and their Settlement Mechanism

- Foreign Exchange Markets

- Structure, Functions and Regulation

- Pricing of Forwards & Futures and Interest Rate Swaps

- Concept of Interest Rate Parity

- Real Estate, Gold and Collectibles

- Forms of Realty – Land, Residential and Commercial Real Estate vs REITs

- REITs vs InvITs

- Precious Metals – Gold

- Physical Gold vs. Gold Funds vs. Sovereign Gold Bonds vs Gold ETFs Gold Futures vs Gold ETFs – Time Horizon, Cost and Risks

- Art, Antiquities and Collectibles

Chapter 3: Investing in Capital Markets, Operational Aspects and Investment Products

Learning Objectives

3-1 Identify the needs and objectives of your clients and their specific category

3-2 Understand operational aspects of securities investments and norms for introducing clients to various investments

3-3 Discuss direct investments in equity and debt products

3-4 Understand mutual funds and other pooled investments

Topics

- Operational Aspect

- Know Your Client (KYC) and FATCA requirement

- Investor types and the On-boarding process

- Processes in the Account opening of Non-Resident Investors (NRIs)

- Various Investment Products and Vehicles

- Ramifications of PMLA and FEMA

- Limits on Demat account

- Use of Power of Attorney and other Agreements

- Operational aspects of managing account folios

- Nominations, Addition/deletion of name or bank account

- Consolidation, transmission and Lien

- Changes in investor status – NRI to RI, RI to NRI

- Change in Nomination for NRIs

- Mandate of a Bank Account

- Payment instruments – Transformation to Digital Payments

- Role of digital payments in prevention of money laundering and frauds

- Corporate Actions

- Dividends, Stock Split, Bonus and Rights issues

- Buy-back, Delisting of Shares, Mergers & Acquisitions

- Direct Investing

- Risk Management Systems in the Secondary Market

- Capital Adequacy Norms

- Margins and Settlement Guarantee Mechanism

- Price-monitoring, Price Bands and Circuit Breakers

- Online Monitoring and Inspection of books

- Mutual Funds

- Regulatory Framework

- Process, Features and Benefits

- Net Asset Value and Investment Options

- Mutual Fund Products

- Time, Value and Event-based Triggers

- SIP and SWP

- Direct and Regular Plans – Investment Advisors’ Role

- Investing in Mutual Funds through Stock Exchange Platforms

- Use of platform by Investment Adviser and Transaction Feeds

- Taxation Aspect and Basis of Redemption

- Investor’s rights to various disclosures under Mutual Fund schemes

- Portfolio Management Schemes (PMS)

- Registration requirement of Portfolio Manager

- Responsibilities of Portfolio Manager

- Various Costs – Fixed, Performance based, High Watermark, Hurdle, Catch-up

- Direct access vs Regular plans, optimization by Investment Advisers

- Performance disclosure requirement

- Alternative Investment Funds

- Role of Alternative Investment in Portfolio Management

- Categories of AIFs

- Evolution and Growth of AIFs in India

- Suitability and Enablers for AIF Products in India

- Current AIF Market Status

- SEBI Requirements on performance disclosure

- Distressed Securities

- Investment Characteristics

- Role in Investors’ Portfolio

Chapter 4 – Small Savings Schemes and Instruments with Sovereign Guarantee

Learning Objectives

4-1 Understand the features of various Government sponsored schemes for the general public

4-2 Differentiate the factors that make these schemes viable to certain investor profile

4-3 Identify specific goals of general public that are fulfilled by small savings schemes

Topics

- Public Provident Fund (PPF)

- National Savings Certificates (NSC)

- Kisan Vikas Patra (KVP)

- Post Office Monthly Income Scheme (POMIS)

- Senior Citizens Savings Scheme (SCSS)

- Sukanya Samriddhi Yojana

- Sovereign Gold Bonds (SGBs)

Chapter 5: Investing in Fixed Income Securities

Learning Objectives

5-1 Understand the ecosystem of fixed-income investments and the role of debt markets to finance Government and the Corporate

5-2 Understand demand side and supply side players in debt market and the typical debt instruments

5-3 Attribute the performance of various debt instruments in client portfolios

Topics

- Role of Debt markets in India in financing Government and the Corporate

- Bond market ecosystem in India

- Role of the Debt Market

- Resources raised by Borrowers

- Perspectives on Mobilization

- Government Debt Market

- Types of Instruments

- Government Securities

- Treasury Bills

- Cash Management Bills

- Sub-types of Government Securities State

- Development Loans

- Demand and Supply side Players and Intermediaries

- Corporate bonds

- Corporate Debt Market

- Key Demand and Supply Side Players

- Company Deposits

- Bonds and Debentures

- Infrastructure Bonds

- Inflation-indexed Bonds

- Zero-coupon Bonds and Deep Discount Bonds

- Tax-free Bonds

- Masala Bonds and FCCBs

- Convertible Bonds

- Pass Through Certificates and Security Receipts

- Intermediation

- Attribute Portfolio Performance and Evaluate Investment Alternatives

- Debt Instruments vs. Debt Funds

- Bank Fixed Deposit vs. Fixed Maturity Plans

- Open ended debt funds vs. FMPs

- Company deposits vs debentures

Chapter 6: Evaluation of Ecosystem and Client Sensitivity in Managing Situations

Learning Objectives

6-1 Understand some practical aspects of client sensitivities to risk and their peculiar behaviour to be so addressed for decision-making

6-2 Know about the benchmarking of portfolios and their analysis

6-3 Evaluate various parameters relevant to portfolio construction to address market risk and other risks

6-4 Understand aspects of stock analysis and various valuation methods and uses, nuances of research

Topics

- Client Sensitivities – Some Practical Aspects

- Understanding Clients – Risk Averse and Risk Seeking

- Risk Tolerance Questionnaires – Impact of Framing

- Dilution in Risk Management due to Overconfidence (Adviser/Client)

- Goal setting and Emotions

- Retail Therapy – Emotional Spending to Escape Stress

- Understanding and Addressing Home Country Bias in Investing

- Optimizing Diversification and Portfolio Turnover

- Tendency of Chasing Past Performance

- Decision-making by Clients

- Bounded Rationality

- Prospect Theory

- Benchmarking and Peer Group Analysis

- Characteristics of Indices for Benchmarking and Errors

- Customized Benchmark

- Managers’ Universe Analysis

- Performance attribution analysis

- Assets and Sector Allocation

- Selection, Market-timing versus Selectivity and Net Selectivity

- Local currency versus foreign currency denominated investment return

- Address few critical risks to Investing in Equities

- Market Risk

- Risks specific to Sectors and Individual Companies

- Transactional Risk and Liquidity Risk

- Stock Analysis process

- Sector Classification and Sectoral Rotation

- Buy-side Research versus Sell-side Research

- Fundamental Analysis – DCF and other Valuation Driven Models

- Relative Valuation in Market Driven Models

- EVA and MVA; EV/EBITDA Ratio; EV/Sales Ratio

- Dividend Yield and Earning Yield

- Industry/Sector Specific Valuation Matrices

- Combining relative valuation and discounted cash flow models

- Advantages of Technical Analysis

- Fixed-income Securities and Technical Analysis

- Fusion Investing

- Diversification of Risk – Equity/Other Assets – Cross Sectional vs. Time Series

- Qualitative Evaluation of Stocks – Corporate Governance Aspect

- Sources of Performance Data – Mandated by the Regulator and Industry

Chapter 7: Financial Advisory and Financial Planning

Learning Objectives

7-1 Illustrate the need for financial advisory services

7-2 Determine the financial position of clients

7-3 Assess insurance needs and requirements

7-4 Construct the retirement planning process

7-5 Analyze tax efficiencies

7-6 Understand estate planning

Topics

- Need for Financial Advisory Services

- Financial Advisory and Execution

- Scope of Financial Planning Services and Process

- Evaluating the financial position of clients: Assets, Liabilities and Net worth

- Trade-off between Investing Money and Paying-off Loans

- Strategies to get rid of debt faster – Avalanche, Snowball, Blizzard

- Analysis of Household Budget and Contingency Planning

- Determination of Financial Goals of Investments/Assets and Strategies

- Attribute Portfolio Performance and Evaluate Investment Alternatives

- Mutual Funds vs Portfolio Management Services (PMS) vs AIF

- Direct Equity vs. Equity Mutual Funds

- Actively Managed Equity Mutual Funds vs Index Funds

- ETFs versus Index Funds

- Mutual funds vs ULIP

- ELSS vs Other Tax Saving Instruments

- Risk Management and Insurance

- Life Insurance Needs Analysis, Economic Value, Covering Future Income Stream

- Assets Coverage, Health and Mortgage Insurance, Liability Cover

- Evaluation of Alternative Strategies

- Critical illness policy vs. Critical illness rider

- Personal Accident insurance v/s Life insurance

- Retirement planning

- Retirement Objectives: Living Expenses, Gifts/Bequest and Charity

- Assessment – Personal and Economic Indicators, Returns, Special Needs

- Analysis of Retirement Products: Provident Funds, NPS, Other Vehicles

- Retirement Funds, Pension/Annuities, Fixed and Liquid Assets, Other Income Sources

- Evaluation of Alternative Strategies

- Market-linked Retirement Products (NPS, ELSS, MF, ULPP) vs EPF/PPF

- Personal Tax Optimization, Tax incidence and Tax Efficiency

- Tax Compliances, Tax Incidence of Holding, Transfer and Liquidation of Assets

- Tax Efficiency of Investment Products and Other Transactions

- Tax induced distortions – Buying Life Insurance for Tax Saving

- Estate Planning

- Characteristics and efficiency of various Estate vehicles – Wills and Trusts

- Tax Efficiency of Gifts, Transfers on Succession

- Succession planning for Businesses: Family Office and Family Trust

Module IIIA. Global Regulatory Environment, Law and Compliance

Chapter 1: Introduction to the Regulatory Environment

Learning Objectives

1-1 Explain how the regulatory environment is related to financial services

1-2 Describe the various regulatory bodies, their function and responsibilities

1-3 Demonstrate Knowledge Items of relevant regulatory, economic and political environments

1-4 Demonstrate relevant Knowledge Items of law and consider and discuss the impact of compliance issues on the practice of financial advice

Knowledge Items

- What is financial regulation?

- Economic

- Safety

- Corporate governance and securities regulation

- Information

- Regulators

- Legislation and regulation

Chapter 2: Legislated “Client Best Interest” Requirement

Learning Objectives

2-1 Describe the legal framework within which financial advisors operate and their legal, social and ethical responsibilities

Knowledge Items

- The fiduciary standard

- Fiduciary duty and suitability

Chapter 3: Economic Environment and Financial Advice

Learning Objectives

3-1 Demonstrate basic Knowledge Items of micro- and macro-economic environment effects as they apply to financial planning and financial advice

3-2 Explain the impact of monetary and fiscal policy

3-3 Understand the normal business cycle and its impact on financial planning and financial advice

3-4 Understand economic indicators and their impact

Knowledge Items

- Monetary and fiscal policy

- Monetary policy

- Open market operations

- Discount rate

- Reserve requirements

- Fiscal policy

- Economics 101

- Economic indicators

- Business cycle

- Expansion

- Downturn and contraction

- Recession and depression

- Recovery

- Economic indicators revisited

- Economics overview

- Macroeconomic schools of thought

Chapter 4: Social and Political Environments

Learning Objective

4-1 Demonstrate Knowledge Items of social and political environments relevant to financial planning, financial advice and the economic environment

Knowledge Items

- Government and politics: local government sentiment

- Local economic environment

- Regional economic environment

- Global economic environment

- Social welfare policy

- Retirement policy

Chapter 5: Compliance and Implications

Learning Objectives

5-1 Describe the impact of legal, regulatory and ethical compliance issues on the practice of financial advice

Knowledge Items

- Disclosure documents

- Potential conflicts of interest

Chapter 6: Anti-Money Laundering

Learning Objectives

6-1 Understand money laundering, its purpose and practice

6-2 Identify global laws and regulations designed to counter money laundering

6-3 Understand how to avoid money laundering personally and by clients

6-4 Describe how financial advisors can comply with relevant anti-money laundering regulation

6-5 Assess the potential risks affecting the financial system, their impact on financial service products, providers, clients and economic performance

6-6 Assess relevant case histories involving financial advisors

Knowledge Items

- The three stages of money laundering

- Global rules and regulations

- Detecting money laundering

- Case studies

Module IIIB. India-Specific Regulatory Environment of Financial Sector

Chapter 1: Regulatory System and Environment

Learning Objectives

1-1 Explain how the Indian financial sector is governed

1-2 Understand the multiple Acts, Rules and Regulations and the five majority bodies

Topics

- Reserve Bank of India (RBI)

- Securities and Exchange Board of India (SEBI)

- Insurance Regulatory and Development Authority of India (IRDAI)

- Pension Fund Regulatory and Development Authority (PFRDA)

- Forward Markets Commission (FMC) [merged with SEBI on September 28, 2015]

Chapter 2: Role of Regulators

Learning Objectives

2-1 Identify the role of regulators

Topics

- Regulation-making

- Executive functions

- Administrative law functions

- Consumer Protection

- Micro-prudential Regulation – Manage Systemic Risk

- Resolution

- Financial Inclusion and Market Development

- Capital Controls

- Public Debt Management

- Monetary Policy

Chapter 3: Acts Relevant to Corporate Entities, Securities and External Trade

Learning Objectives

3-1 Distinguish Acts in India specific to financial sector regulation

Topics

- The Companies Act, 2013 (erstwhile 1956)

- The Indian Trusts Act, 1882

- The Securities Contracts Regulation Act, 1956

- The Securities and Exchange Board of India Act, 1992

- The Foreign Exchange Management Act, 1999

- The Prevention of Money Laundering Act, 2002 (PMLA)

- The Insolvency and Bankruptcy Code, 2016 (IBC)

- Negotiable Instruments Act, 1883

- The Forward Contracts Regulation Act, 1952

- The Indian Contract Act, 1872The Indian Partnership Act, 1932

- The Limited Liability Partnership Act, 2008

Chapter 4: Consumer Grievances Redressal

Learning Objectives

4-1 Understand consumer grievances redressal under various regulators

4-2 Distinguish nuances of comprehensive consumer empowerment in the digital era

Topics

- Redress in Banking – The Banking Ombudsman Scheme 2006 (amended July 1, 2017)

- Investor Grievance Redress Mechanism – SEBI Complaints Redress System (SCORES) platform

- Insurance Ombudsman Scheme

- Stipendiary Ombudsman – PFRDA

- The Consumer Protection Act, 2019 (new act)

Chapter 5: Other Acts, Statutes and Regulations Relevant to Financial Consumers

Learning Objectives

5-1 Understand other Acts, Statutes and Regulations impacting financial consumers

Topics

- Right to Information Act, 2005 RTI)

- SEBI (Disclosure and Investor Protection) Guidelines, 2000 (DIP)

- IRDAI (Protection of Policyholders’ Interests) Regulations, 2017

Chapter 6: Regulation of Market Intermediaries in Financial Products

Learning Objectives

6-1 Compare regulations of market intermediaries in financial products

Topics

- SEBI (Intermediaries) Regulations, 2008

- SEBI (Investment Advisers) Regulations, 2013

- SEBI (Self-Regulatory Organizations) Regulations, 2004

- PFRDA Retirement Adviser) Regulations, 2016

- PFRDA (Point of Presence) Regulations, 2015

- IRDA (Licensing of Insurance Agents) Regulations, 200

FPSB Certification Code of Ethics (for all FPSB certifications)

FPSB LTD. CODE OF ETHICS

Observing the highest ethical and professional standards allows professionals to serve the interests of clients and promote the profession for the benefit of society. As part of their commitment, professionals should provide appropriate disclosures and comply with ethical standards when delivering advice to clients. FPSB has incorporated ethical behavior and judgment, and compliance with ethical standards, into its global standards for professionals. To ensure these obligations are understood, FPSB incorporates ethical standards into its certification requirements.

FPSB’s Code of Ethics Principles are statements expressing in general terms the ethical standards that professionals should adhere to in their professional activities. The comments following each Principle further explain the intent of the Principle. The Principles are aspirational and are intended to provide guidance for professionals on appropriate and acceptable professional behavior.

FPSB’s Code of Ethics Principles reflect professionals’ recognition of their responsibilities to clients, colleagues and employers. The Principles guide the performance and activities of anyone involved in the practice of advice; the concept and intent of these Principles are adapted and enforced on professionals by FPSB through rules of professional conduct.

Principle 1 – Client First

Place the client’s interests first

Placing the client’s interests first is a hallmark of professionalism, requiring the specialist to act honestly and not place personal gain or advantage before the client’s interests.

Principle 2 – Integrity

Provide professional services with integrity.

Integrity requires honesty and candor in all professional matters. Professionals are placed in positions of trust by clients, and the ultimate source of that trust is the specialist’s personal integrity. Allowance can be made for legitimate differences of opinion, but integrity cannot co-exist with deceit or subordination of one’s principles. Integrity requires the specialist to observe both the letter and the spirit of the Code of Ethics.

Principle 3 – Objectivity

Provide professional services objectively.

Objectivity requires intellectual honesty and impartiality. Regardless of the services delivered or the capacity in which a specialist functions, objectivity requires that professionals ensure the integrity of their work, manage conflicts of interest and exercise sound professional judgment.

Principle 4 – Fairness

Be fair and reasonable in all professional relationships. Disclose and manage conflicts of interest.

Fairness requires providing clients what they are due, owed or should expect from a professional relationship, and includes honesty and disclosure of material conflicts of interest. Fairness involves managing one’s own feelings, prejudices and desires to achieve a proper balance of interests. Fairness is treating others in the same manner that you would want to be treated.

Principle 5 – Professionalism

Act in a manner that demonstrates exemplary professional conduct.

Professionalism requires behaving with dignity and showing respect and courtesy to clients, fellow professionals, and others in business-related activities, and complying with appropriate rules, regulations and professional requirements. Professionalism requires the specialist, individually and in cooperation with peers, to enhance and maintain the profession’s public image and its ability to serve the public interest.

Principle 6 – Competence

Maintain the abilities, skills and knowledge necessary to provide professional services competently.

Competence requires obtaining and maintaining an adequate level of abilities, skills and knowledge in the provision of professional services. Competence also includes the wisdom to recognize one’s own limitations and when consultation with other professionals is appropriate or referral to other professionals necessary. Competence requires the specialist to make a continuing commitment to learning and professional improvement.

Principle 7 – Confidentiality

Protect the confidentiality of all client information.

Confidentiality requires that client information be protected and maintained in such a manner that allows access only to those who are authorized. A relationship of trust and confidence with the client can only be built on the understanding that the client’s information will not be disclosed inappropriately.

Principle 8 – Diligence

Provide professional services diligently.

Diligence requires fulfilling professional commitments in a timely and thorough manner and taking due care in delivering professional services.